Class 8 Build Rates Suggest Upside to The 2019 Forecast, But…

When Change Comes, It Is Likely to Come Fast

According to ACT Research’s (ACT) latest release of the North American Commercial Vehicle OUTLOOK, current Class 8 build rates suggest upside to the 2019 forecast, but large new truck inventories and deteriorating freight and rate conditions suggest erring on the side of caution remains the right call: When the change comes, it is likely to come fast.

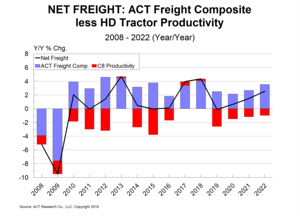

“Since March 2018, ACT’s forecasts have targeted Q3’19 as the quarter in which the supply of Class 8 tractors and demand for freight services were likely to tip so far as to break the current period of peak vehicle production, as demand reverts to the mean,” said Steve Tam, ACT’s Vice President. He elaborated, “Current data and anecdotes make a strong case that the call for a Q3’19 inflection point expectation remains intact.”

Regarding heavy vehicle demand, Tam noted, “At the heart of our cycle duration prediction, carrier profitability and production peaks always lag the freight cycle, so capacity building always accelerates relative to freight growth at exactly the wrong time.” He added, “Hence, cycle duration ultimately comes down to timing and excluding the prebuy and housing bubble impacted 2004-2006 cycle, peak of cycle build rates has historically lasted between 13 and 15 months. For this Class 8 cycle, we date peak build rates to June 2018, so we are currently in 12 months.”

Regarding ACT’s medium duty forecasts, Tam said, “Slower orders are negating upward pressure previously exerted on the forecast. For trucks, segment analysis preliminary May orders were more than 2,500 units below the 12-month trend, with similar developments in the bus and RV segments leading to a like comparison for the total Classes 5-7 market.”

Category: Featured, General Update, News