Freight Recession Possible, Rate Recession Likely

ACT Research Releases New Freight Forecast Report

ACT Research released a new monthly report focusing on the future of the US trucking industry, titled ACT Freight Forecast, U.S. Rate and Volume OUTLOOK. The report covers the truckload, intermodal, LTL and last mile sectors.

“Truckload spot rates are set to soften further due to tractor capacity additions, pulling the contract rate market down by mid-year. LTL rates will be most resilient and continue to rise due to the unique dynamics in that market, but TL and intermodal rates are heading lower,” said Tim Denoyer, ACT Research’s Vice President and Senior Analyst.

Dry van rates, net fuel, fell 15% y/y in Q1 and are likely to drop 20% y/y in the coming months. Freight growth has slowed materially, and it’s not just timing effects from shippers positioning around tariff threats. The headwinds to for-hire freight volumes in 2019 include tariffs, tighter financial conditions, the industrial slowdown, housing and auto softness, and fast private fleet growth.

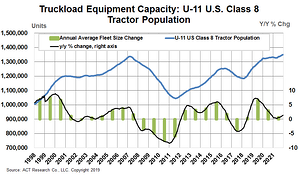

Denoyer continued, “While this presents risk of a freight recession in 2019, we do expect the US consumer to keep volumes growing, just very slowly. Critically, this slowdown in freight is happening just as truckload capacity is accelerating. After growing less than freight for most of last year, truckload capacity has accelerated to 7% y/y growth in early 2019. We think this is the key story behind lower spot rates and why the pricing pendulum is starting to swing to the shipper.”

Category: Featured, General Update, News