New-vehicle Retail Sales Recovery Sees Slight Pause in July

Consumer Expenditures Nearly Flat vs. 2019

The Retail Sales Forecast

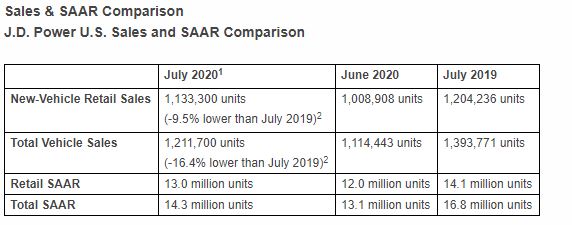

New-vehicle retail sales in July are expected to be down from a year ago, according to a joint forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,133,300 units, a 4.0% decrease compared with the J.D. Power pre-virus forecast and a 9.5% decrease compared with July 2019. Reporting the same numbers without controlling for the number of selling days translates to a decrease of 5.9% from a year ago. (Note: July 2020 contains one additional selling day than July 2019.)

The Total Sales Forecast

Total sales in July are projected to reach 1,211,700 units, a 16.4% decrease from July 2019. Reporting the same numbers without controlling for the number of selling days translates to a decrease of 13.1% from July 2019. The seasonally adjusted annualized rate (SAAR) for total sales is expected to be 14.3 million units, down 2.5 million units from a year ago.

The Takeaway

Thomas King, president of the data and analytics division at J.D. Power:

“July represents a slight pause in the overall recovery, with retail sales down 4-5% compared with the J.D. Power pre-virus forecast for the second consecutive month.” Among the top 100 U.S. markets, just eight of them are expected to post year-over-year sales gains. Notable markets among those expected to show gains include Detroit, Buffalo and Milwaukee.

“One factor contributing to the pause in recovery in July is inventory constraints for many vehicles,” King said. “While this is constraining overall sales, new production is arriving at dealerships daily and is being sold quickly to consumers.” This month, 41% of all vehicles sold will spend fewer than 20 days on dealer lots, up from 35% a year ago.

Incentive spending continues to fall from the record levels of April but remains up slightly from a year ago. Spending is on pace to reach $4,236 in July, an increase of $166 from July 2019. Reporting spending expressed as a percentage of the average vehicle MSRP is 10.3%, nearly flat from last year. “While the deals in market are still relatively strong, they aren’t exceptional like they were are few months ago,” King said. “This points to strong underlying consumer demand for new vehicles.”

—–

The shift in consumer demand toward more expensive trucks/SUVs continues to support record transaction prices in July. For the fourth consecutive month, trucks/SUVs are on pace to account for 76% of retail sales. As a result, transaction prices are expected to rise by 5.9% to $35,151, the highest ever for the month of July and second-highest level ever.

Record prices are helping to offset the decline in sales, with consumers expected to spend $39.8 billion on new vehicles in July. This represents a decline of only $139 million or 0.3% from a year ago.

—–

Through the first seven months of the year, retail sales are expected to reach 6.4 million units, a decline of 17% from a year ago. While this represents the slowest start to the year since 2011, prices in 2020 are soaring to the highest level ever. Average transaction prices through the first seven months are on pace to reach $34,634, an increase of 3.8% through the first seven months of 2019 and up 24.2% vs. the first seven months of 2011.

Consumers will spend $223 billion on new vehicles from January through July, a decline of $34 billion from a year ago—but an increase of more than $58 billion from the same period in 2011.

—–

Looking ahead, a quirk in the calendar and reduced inventory levels present some unique sales challenges in August. Typically, sales promotions related to the Labor Day holiday are pulled ahead into August due to the proximity of the holiday. This year, the Labor Day holiday occurs later in September, seven days after the end of August. “The unusual gap between the August close combined with reduced inventory levels means we may see less promotional activity at the end of the month,” King said. “As a result, August sales may appear to take a step back from the overall recovery pattern.”

Despite the volatility, retailers have adopted to the challenging environment and continue to post significant growth in margins on new-vehicle sales. Total grosses inclusive of finance and insurance incomes are on pace to reach $1,922 per unit, up $620 from last year and the highest level ever in July. King noted, “The strong per-unit grosses offer some mitigation to the lower sales pace.”

1Figures cited for July 2020 are forecasted based on the first 15 selling days of the month.

2July 2020 has 26 selling days, one less more than July 2019.

The Details

- The average new-vehicle retail transaction price in July is expected to reach $35,151. The previous high for the month of July, $33,196, was set in July 2019.

- Average incentive spending per unit in July is expected to reach $4,236, up from the previous record for the month of $4,069, set in July 2019. Spending as a percentage of the average MSRP is 10.3%, up 0.1 percentage points from last year.

- Incentive spending on cars is expected to be up $269 to $3,886, while spending on trucks/SUVs is up $106 to $4,343.

- Consumers are on pace to spend $39.8 billion on new vehicles, down $139 million from July 2019.

- Truck/SUVs on pace to account for 75.5% of new-vehicle retail sales, the highest level ever for the month of July.

- Fleet sales are expected to total 78,300 units, down 60% from July 2019. Fleet volume is expected to account for 6.5% of total light-vehicle sales, down from 14% a year ago.

Global Outlook for July 2020

Jeff Schuster, president, Americas operations and global vehicle forecasts, LMC Automotive:

“The global automotive market continues on a resilient path of recovery, as June sales were down 17% from a year ago on strength in China and South Korea. Most key markets around the world are entering an important phase in the reopening that will test new procedures for manufacturing and the vehicle-selling process. Risk for the remainder of 2020 and into 2021 remains elevated but the market’s path forward is currently better than previously expected.”

Global light-vehicle sales through June YTD are down 27% from the same period in 2019 with improvement being seen in all markets from the low point in April. As prospects for an economic recovery continue, the global outlook for 2020 has been raised to a forecast of 73 million units, up from a low of 67 million forecasted in April. This is a decline of 20% from 2019.

Category: Equipment, Featured, General Update, News, Vehicles