DAT: Weather, End-of-month Rush Send Spot Truckload Ratios Higher

DAT Trendlines, week ending Feb 1, 2021

The number of spot truckload posts increased 19% last week as shippers cleared their docks to meet end-of-month targets and get ahead of Winter Storm Orlena, the first major snowstorm of 2021, said DAT Freight & Analytics, which operates the industry’s largest load board network and freight data analytics service.

The number of available trucks on the spot market declined 8%, sending national average load-to-truck ratios higher. National average spot van and refrigerated freight rates were virtually unchanged compared to the previous week after softening throughout the month of January.

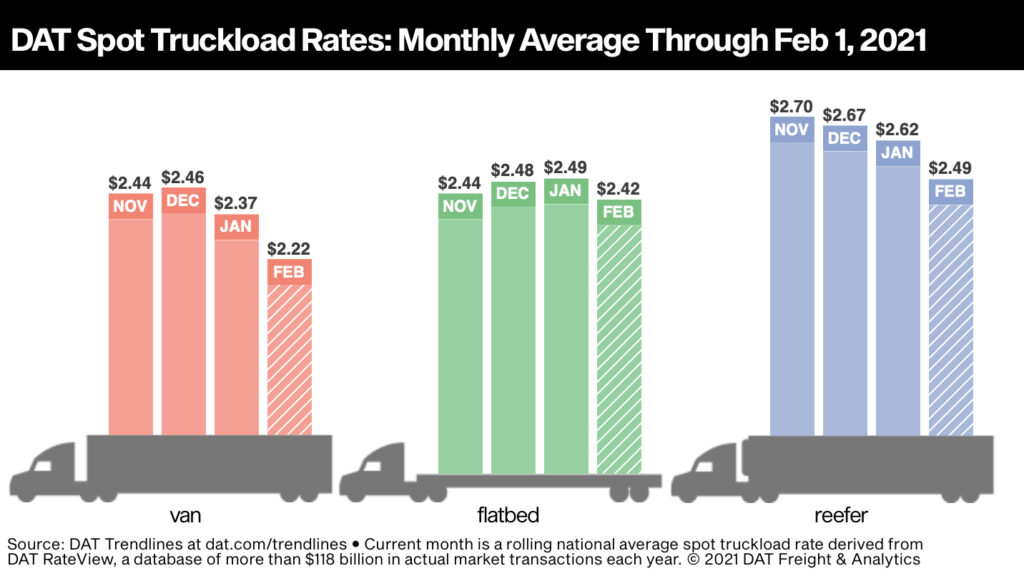

National Average Rates, January

– Van: $2.37 per mile, $2.13 line-haul

– Flatbed: $2.49 per mile, $2.20 line-haul

– Refrigerated: $2.62 per mile, $2.35 line-haul

Spot rates are an “all-in” rate, combining a line-haul portion and a calculated fuel surcharge. The gap between the all-in rate and the line-haul rate has increased in recent weeks with rising cost of fuel. At $2.74 a gallon, the national average price of diesel fuel is at its highest point since March 2020.

Entering February, the national average spot van rate was $2.22 per mile; flatbed was $2.42 per mile; and the reefer rate was $2.49 per mile—well below their January averages. These averages are based on actual transactions negotiated between the carrier and broker or shipper and include a fuel surcharge.

Trendlines

Van load-to-truck ratio improved last week: The national average van load-to-truck ratio increased from 3.2 to 4.3 last week and the number of loads moved on DAT’s top 100 van lanes by volume was up 3.9%. The average spot truckload rate fell on 72 of those 100 lanes, however. It increased on 14 lanes and was neutral on 14 others. While weaker spot van rates and volumes are typical for late January, the average spot rate slipped below the contract rate for the first time in nearly seven months.

Reefer ratio edged higher: The national average reefer load-to-truck ratio was 8.7, up from 5.9 the previous week. The number of loads moved on DAT’s top 72 reefer lanes by volume increased by just under 1% week over week and the average rate was lower on 59 of those lanes.

Flatbed activity picked up: The average flatbed load-to-truck ratio rose from 44.9 to 53.0 and the number of loads moved on DAT’s top 78 flatbed lanes by volume jumped 19.3% last week. The number of loads moving was higher on 67 lanes, week over week, although the direction of rates wase mixed: 19 lanes were up, 37 lanes were neutral, and 22 lanes were down compared to the previous week. While the gap between spot and contract rates for vans and reefers has narrowed substantially, contract flatbed rates have outpaced spot rates by roughly 15 cents a mile for the last 12 months.

Rates softened on high-volume lanes: Rates continue to fall from historic highs, especially on the country’s busiest lanes. Ontario, California, 60 miles inland from the ports of Los Angeles and Long Beach, is a major warehousing and distribution market for retail goods and other freight coming into the U.S. The DAT Ratecast 3-day average spot van rate from Ontario to Stockton, the nation’s busiest lane for spot van freight last week, has plummeted from $3.60 a mile just four weeks ago to $2.93 a mile. Prior to Christmas, the rate averaged around $4 a mile.

The No. 2 lane by volume was Ontario to Phoenix, which averaged $3.20 a mile. At its November peak, this lane averaged $4.56 a mile.

In the refrigerated sector, Atlanta to Lakeland, Florida, has declined 30 cents over the last four weeks to an average of $3.47 a mile. Los Angeles to Stockton is down 45 cents to $3.18 a mile over the same period, and Ontario to Phoenix is off 85 cents to $3.68 a mile.

Rates from Miami rallied ahead of Valentine’s Day: It’s peak shipping season for Valentine’s Day flowers. In January alone, U.S. Customs and Border Protection processed more than 496 million cut flowers, with most of the activity centered on Miami.

According to the U.S. Dept. of Agriculture, 91% of rose stems land at Miami International Airport before being trucked across the U.S. and Canada. During the seven weeks leading up to Valentine’s Day, an average of 500 truckloads of flora per day will head out of Miami, with roughly 80% of this volume handled by just three carriers using company-owned trucks as well as independent contractors to handle surging shipments of roses in particular.

Load-post volumes in Miami were up 19% week over week while the average outbound spot reefer rate increased 10 cents to $1.51 a mile. On heavy-volume lanes, including Miami-New York City, spot rates averaged $2.24 a mile and have touched as high as $2.48 a mile.

For truck drivers, many floral loads are anything but sweet. Few receivers have docks, so drivers have to unload boxes themselves, and because flowers are perishable, time is of the essence. To compensate, some large flora carriers impose a holiday surcharge during the weeks leading up to Valentine’s Day.

Category: Driver Stuff, Equipment, Featured, General Update, Management, News