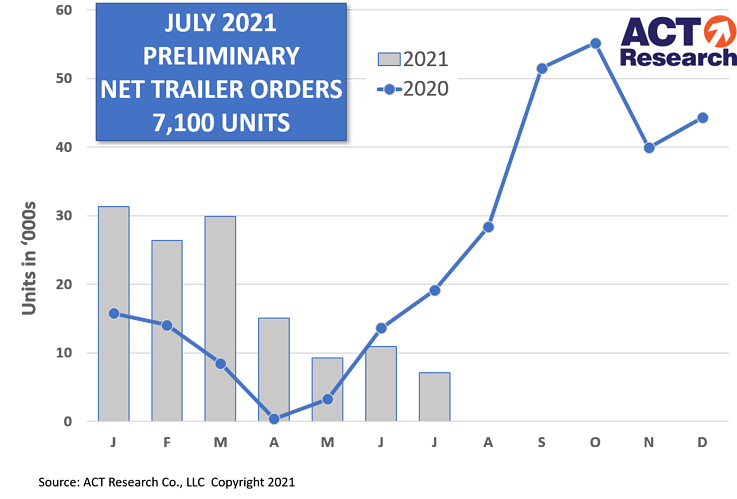

July Preliminary Net Trailer Orders at 7,100 Units, 35% Less than June and 63% Lower Than Last Year

ACT Research reports show trailer OEMs posted 7,100 net orders in July, roughly two-thirds of June’s volume and 63% less than the same month last year

Preliminary reports show trailer OEMs posted 7,100 net orders in July, roughly two-thirds of June’s volume and 63% less than the same month last year. Final July volume will be available later this month. This preliminary market estimate should be within +/- 5% of the final order tally.

“Trailer orders remained low for the fourth consecutive month in July. The issue is certainly not demand related, as fleets remain bullish regarding equipment acquisition. With existing orderboards stretching through the end of Q1’22 on average and well into Q2’22 for dry vans and reefers, OEMs continue to limit order acceptance,” said Frank Maly, Director CV Transportation Analysis and Research at ACT Research. He added, “OEMs’ concerns regarding their supply chain, staffing availability, and pricing of components and materials are mainly responsible for the continued reluctance to accept further orders in the near-term. However, when the order season eventually opens, expect a surge of pent-up volume to flood in, likely resulting in a very significant commitment of available 2022 production capacity.”

Maly commented further on production capacity and levels. “Initial reports indicate that OEMs were unable to increase daily production rates in July, as supply chain and staffing headwinds continue to challenge ramp-up efforts in response to their solid orderboards. While some announcements point to additional industry capacity coming online, those continuing component and staffing issues could make it challenging to fully utilize that potential in the near-term.”

Category: Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Vehicles