New Uber Freight Report Examines the Future of Autonomous Trucking

Autonomous trucks present a tremendous opportunity to improve the safety of our roads as well as alleviate growing strain across supply chains.

Approximately 5,000 lives have been lost in large-truck crashes each year since 2018, with a record high increase of 13% last year. Historically, the vast majority of these accidents are caused by human error.

On top of these safety concerns, the trucking industry also faces a driver supply On top of these safety concerns, the trucking industry also faces a driver supply crisis. Despite recent efforts to lower the age of entry, long-term demand for drivers continues to outpace supply. Driver shortage and retention have been among the top 10 issues facing the trucking industry for 10 years in a row, according to a survey by the American Transportation Research Institute. This crisis is likely to be further exacerbated by the looming cliff of hundreds of thousands of impending trucker retirements over the next decade.

Uber Freight envisions a future where autonomous trucks and human drivers operate alongside one another in a hybrid network to ease the burden of increased freight demand, enhance truck drivers’ quality of life, and create more value for everyone in the supply chain. That’s why we launched an industry-first strategic partnership with Waymo that unlocks billions of autonomous miles on Uber Freight’s network for years to come. Additionally, Uber Freight is currently running a multiphase pilot program with Aurora where Uber Freight is also learning how to integrate the Aurora Driver into its digital freight network.

On the back of these partnerships, Uber Freight is unveiling a road map for the practical deployment of this vision, as well as detailed research exploring the impact autonomous trucks will have on truck driver jobs, operating costs, and the movement of goods overall.

Among the key findings of the research are:

The hub-to-hub model represents a practical starting point for the accelerated deployment of autonomous trucks

- For the foreseeable future, most autonomous trucks will operate under a hub-to-hub model, where human drivers handle the trip ends, which involve complex urban streets, and autonomous trucks will service the middle on highways.

- Using a nationwide freight model, we find that the hub-to-hub model presents a sizable opportunity, with an immediate addressable market of 25 billion miles of long-distance dry van freight on the interstate system.

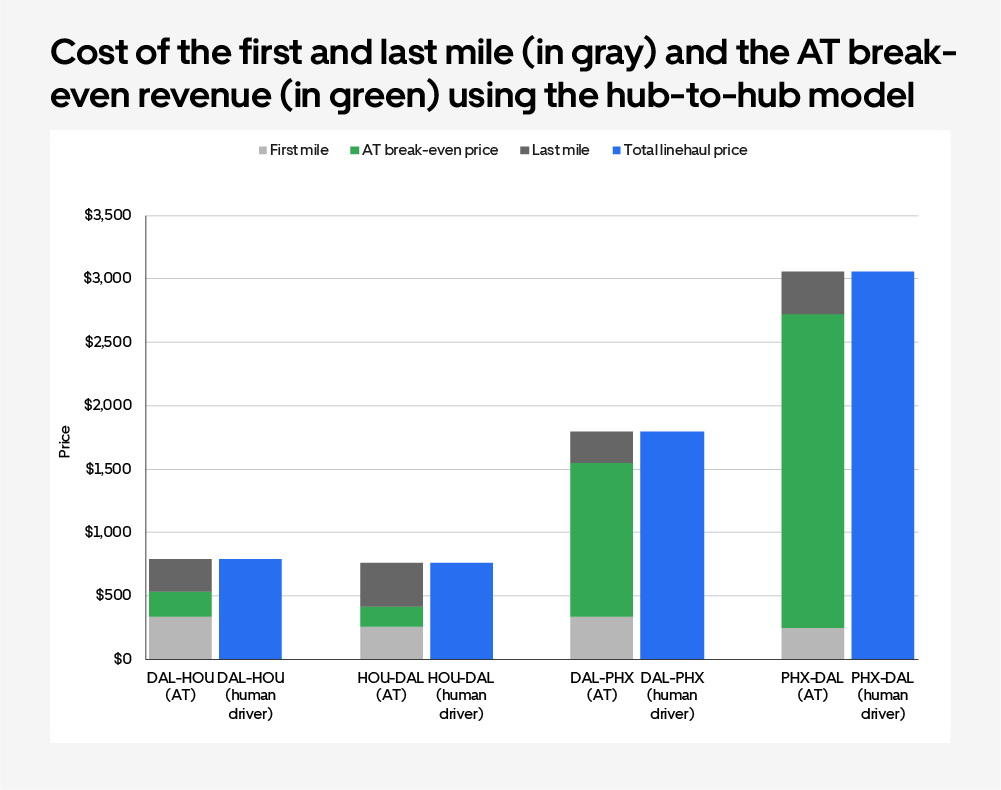

The hub-to-hub model is also economically feasible, especially for long hauls

- Feasibility improves with longer hauls, where the fraction of cost associated with the first and last miles is smaller.

- By analyzing historical carrier pricing data, we find that this model is feasible to all stakeholders on 80% of lanes if AV carriers can achieve a middle-mile cost of $1 per mile, and on 40% of lanes with a middle-mile cost of $2 per mile.1

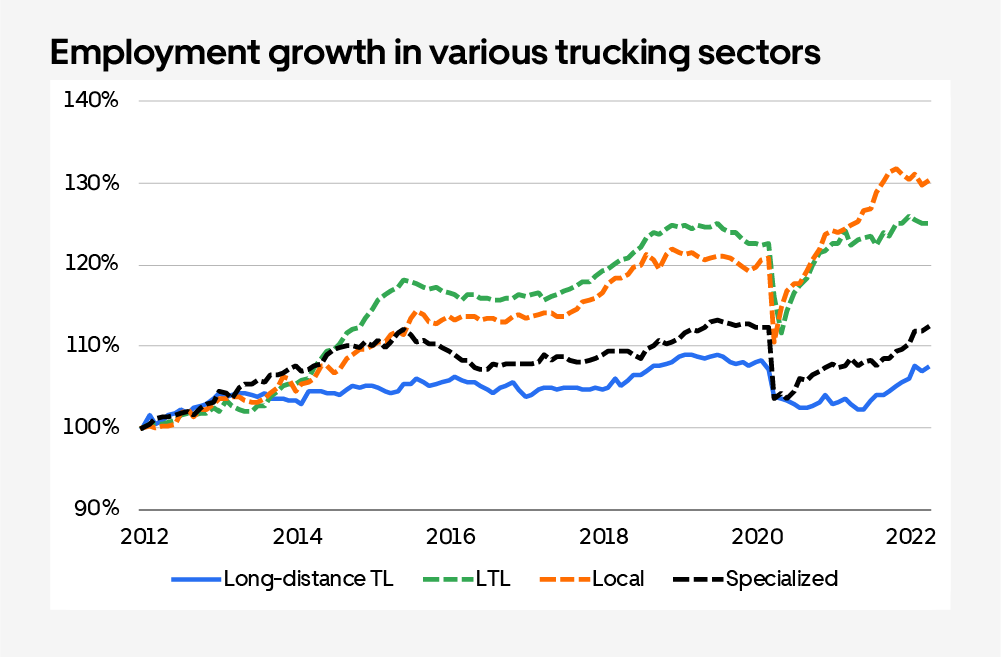

Autonomous trucks within a hybrid network will fill trucking employment gaps, rather than replace human drivers. They will provide capacity where it is needed most: in long-distance trucking

- Using a nationwide model of interstate freight movements, we estimate that 180,000 drivers will be needed to cover 18 billion miles of dry van freight by 2050.

- Autonomous trucks on the long-haul middle mile would enable humans to shift to local hauls, boosting demand for skilled drivers in the local sector. Drivers will have more control over their work and be able to stay closer to home.

- Deployment will expand incrementally along strategic corridors in the US, starting with states where weather and regulations are favorable.

Uber Freight is uniquely positioned as the preferred network and platform to bring more autonomous trucks on the roads and move goods, fast. Our combination of network reach and marketplace innovation ensures that autonomous assets can be deployed and used effectively at scale for the betterment of the entire industry: carriers, shippers, and drivers alike.

We are a strategic adviser for shippers, with the data to help inform how, when, and where to seamlessly deploy autonomous trucks in their network. Combined with Transplace, we also provide the largest carrier base in the US to handle any human-driven legs and manual operations. Our drop-and-hook program, Powerloop, has already laid the foundation for the hub-to-hub model, and our partnerships with the leading AV tech developers empower the trucking industry to explore and adopt this technology as soon as today.

To learn more about our vision for the future of autonomous trucking, download the full white paper.

1This includes all operating costs except for servicing the first and last miles. Therefore, it includes the fixed and variable costs associated with operating the autonomous trucks and transfer hubs.

Posted by Uber Freight

Category: AUTONOMOUS, Connected Fleet News, Driver Stuff, Equipment, Featured, Featured Videos, General Update, News, Safety, Tech Talk, Vehicles