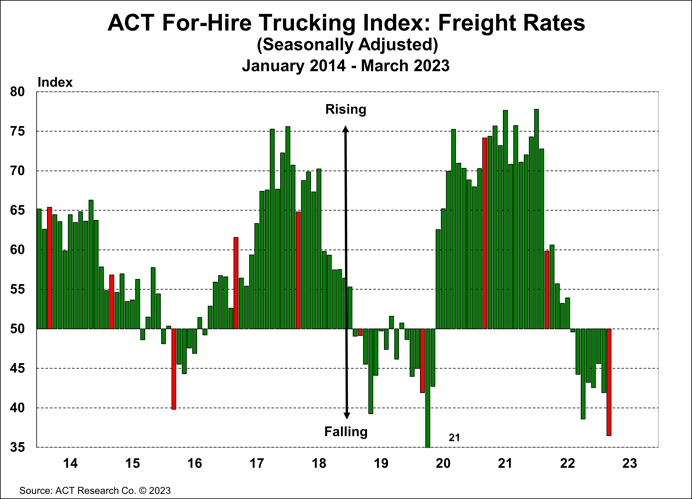

For-Hire Trucking Index Freight Rates Lowest Since April 2020

This is the second lowest reading in the index’s history, with only April of 2020 being lower

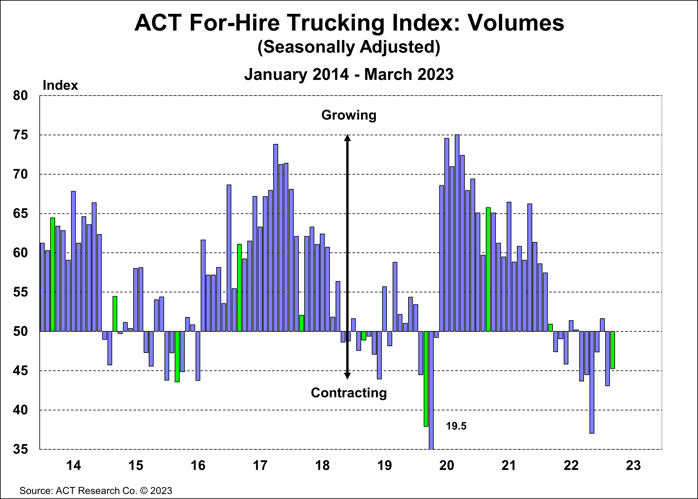

Freight volumes improved, but remained weak, in March, and rates declined further, according to the latest release of ACT’s For-Hire Trucking Index.

The Trucking Volume Index declined by less in March, at 45.3 (SA) versus 43.1 in February. Volumes declined at a slower rate amidst a market of mixed economic signals and rolling recessions.

Tim Denoyer, Vice President & Senior Analyst at ACT Research, commented, “a normal trucking freight cycle includes two-plus years of growth followed by about 18 months of retrenchment. The Volume Index has been below 50 for nine of the past 12 months. While the near-term outlook remains cautious, imports should begin to recover soon. If this cycle is like the last two, demand growth will return in 2024, perhaps even late 2023.”

The Pricing Index’s grim readings continue, falling 5.4 points to 36.5 in March (SA) from 41.9 in February. This is the second lowest reading in the index’s history, with only April of 2020 being lower.

He added, “The cure for low prices is low prices, and with spot rates far below fleet operating costs, capacity is slowing. While the pricing pendulum remains with shippers for now, we see signs that the next capacity rebalancing has begun. We think capacity is set to decline later this year, and rate trends should begin to recover as soon as traction on freight volumes is established.”

The Capacity Index ticked up by 0.6 points m/m to 53.6 in March, but still indicates slower growth than in 2022. Capacity has improved in terms of both equipment and drivers the past year, with improvements in the supply chain boosting truck production and as drivers seek safe harbor with larger, well-capitalized fleets after the sharp fall in spot volumes and rates.

%20Index%20Less%20Capacity%20(Supply)%20Index.png?width=688&height=500&upscale=true&name=ACT%20For-Hire%20Trucking%20Survey%20Supply-Demand%20Balance%20Freight%20(Demand)%20Index%20Less%20Capacity%20(Supply)%20Index.png)

The Supply-Demand Balance continues to be loose, at 41.7 (SA) in March from 40.1 in February, with the m/m increase in volumes outweighing a smaller increase in capacity.

Denoyer concluded, “March marked the thirteenth consecutive underwater point in the series. For context, in the 2015-2016 downcycle, the Supply-Demand Balance was loose for 17 of 19 months. The loose market will persist in the near term, but the seeds have been sown for a rebalancing.”

Category: Driver Stuff, Featured, Fleet Tracking, General Update, Management, News, Transit News, Vehicles