Freight Market Nears Bottom of the Cycle

Freight volumes have been negative vs previous year in six of the last seven months

Moving along in the freight downcycle that began in January 2022, we appear to be close to the bottom. Freight volumes have been negative vs previous year in six of the last seven months. Rates have been negative (y/y) for six consecutive months.

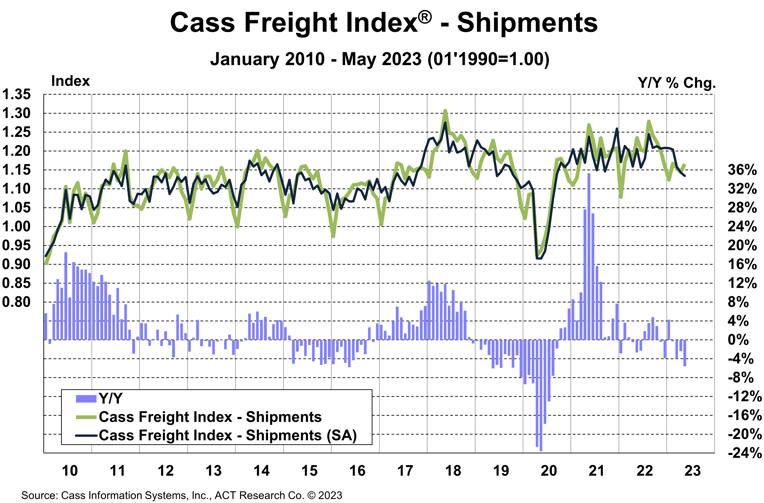

Cass Freight Index – Shipments

The shipments component of the Cass Freight Index® rose 1.9% m/m in May, but fell 0.8% m/m in seasonally adjusted (SA) terms and fell 5.6% y/y. While it was a softer-than-normal seasonal increase from April, it was nonetheless an increase.

- Freight markets continue to work through a downcycle which featured its first y/y decline 17 months ago. The past three downcycles have ranged from 21 to 28 months.

- Declining real retail sales trends and ongoing destocking remain the primary headwinds to freight volumes, but dynamics are shifting as real incomes improve and the worst of the destock is in the rearview.

With normal seasonality, this index would rise slightly m/m in June and still decline about 3% y/y.

See the Methodology for the Cass Freight Index

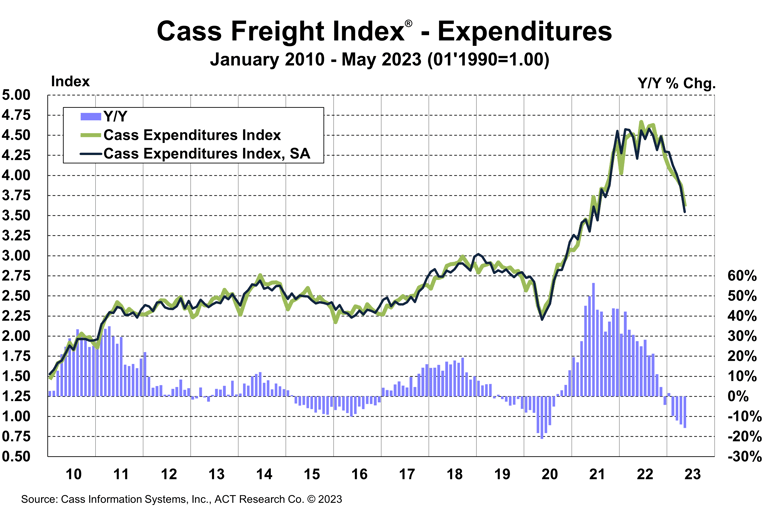

Cass Freight Index – Expenditures

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, fell 6.8% m/m and 15.7% y/y in May.

With shipments up 1.9% m/m in May, we infer rates were down 8.5% m/m (see our inferred rates data series below).

- On a seasonally adjusted basis, the index declined 7.8% m/m, with shipments down 0.8% and rates down 7.1%.

This index includes changes in fuel, modal mix, intramodal mix, and accessorial charges, so is a bit more volatile than the cleaner Cass Truckload Linehaul Index®.

The expenditures component of the Cass Freight Index rose 23% in 2022, after a record 38% increase in 2021, but is set to decline about 16% in 2023, assuming normal seasonal patterns from here. With both freight volume and rates under pressure at this point in the cycle, that assumption could be optimistic, so we may be looking at a ~20% decline in freight spending this year.

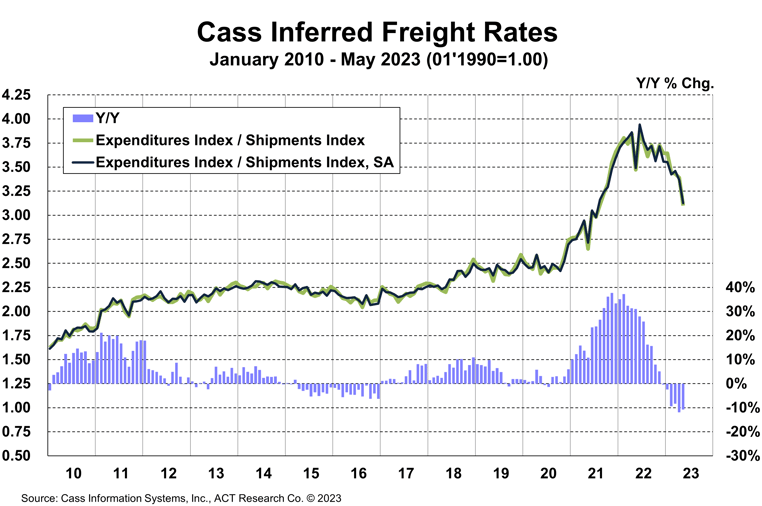

Inferred Freight Rates

The rates embedded in the two components of the Cass Freight Index declined 10.7% y/y in May, after falling 11.9% in April.

- Cass Inferred Freight Rates decreased 7.1% m/m SA after a 2.7% m/m decline in April, as contract rates reset lower and, in part, due to lower fuel prices.

- Based on the normal seasonal pattern, this index wouldn’t change much m/m in June, but the y/y decline would widen to about 20% on a noisy comparison.

- We estimate lower fuel prices are knocking about 5% off freight rates y/y starting here in mid-Q2.

- While fuel is a big factor, there’s clearly also still market pressure on rates.

Cass Inferred Freight Rates are a simple calculation of the Cass Freight Index data—expenditures divided by shipments—producing a data set that explains the overall movement in cost per shipment. The data set is diversified among all modes, with truckload (TL) representing more than half of the dollars, followed by less-than-truckload (LTL), rail, parcel, and so on.

Provided by Cass Transportation Index

Category: Equipment, Featured, Fleet Tracking, General Update, News