Rising Inventories and Decreasing Values Persist for Used Heavy-Duty Trucks and Trailers

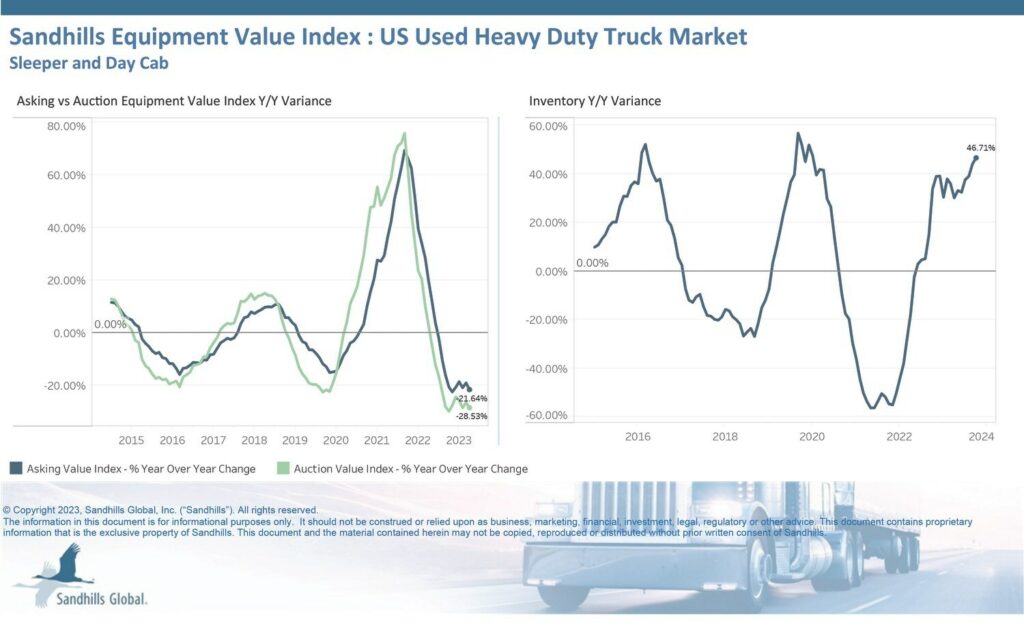

The supply of used heavy-duty trucks in the U.S. has been rising for several months with inventory levels reaching a 46.71% year-over-year increase

According to the newest market reports from Sandhills Global, supply increases throughout 2023 for used heavy-duty trucks, semitrailers, tractors, construction equipment, and lifts in Sandhills marketplaces have not been accompanied by corresponding increases in demand. This has led to a decline in asset values in most equipment, truck, and trailer categories.

“The trend we’re tracking across all three industries—trucks, farm equipment, and construction equipment—is especially pronounced within the heavy-duty truck and semitrailer markets,” says Truck Paper Sales Manager Scott Lubischer. “These markets have declined continually since the last value peaks occurred in Q2 2022.”

High-horsepower tractors (those with 300 horsepower or greater) are the only exception to the trend. This market has shown a greater degree of stability and growth in asking values over the past year compared to other markets. By contrast, the other markets have been weak, with current asking and auction values falling below year-ago levels.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model year equipment actively in use.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

U.S. Used Heavy-Duty Trucks

- The supply of used heavy-duty trucks in the U.S. has been rising for several months with inventory levels reaching a 46.71% year-over-year increase in October. Inventory levels were up 3.35% month over month and are trending up.

- However, the market has not responded with strong demand for the abundance of used trucks, as illustrated by 18 months of consecutive declines in asking and auction values. Asking and auction values were both lower in October than they were last year, reflecting a weak overall market for used heavy-duty trucks. Asking values were down 3.31% M/M and 21.64% YOY and are trending down.

- Auction values were down 4.33% M/M and 28.53% YOY and are trending down.

U.S. Used Semitrailers

- Inventory levels of used semitrailers have exhibited significant growth in 2023. This is particularly true of dry van semitrailers as their supply more than doubled compared to last year. Used semitrailer inventory increased 8.29% M/M following several months of increases and rose 89.15% YOY.

- Increased supply has led to declines in asking and auction values, both of which are trending down. Asking values inched down 0.98% M/M in October after months of decreases and were 19.67% lower than last year.

- Auction values showed a similar pattern, down 1.05% M/M after months of decreases and posting a 25.83% YOY decline.

U.S. Used Medium-Duty Trucks

- Used medium-duty truck inventory levels have surged in 2023. Following months of consecutive increases, inventory levels ticked up 0.34% M/M and rose 44.06% YOY in October.

- Asking and auction values, however, have not risen, and the latest figures indicate a weak demand in this market. Asking values were down 0.12% M/M in October after months of decreases and were 15.21% lower than last year.

- Auction values were up 0.29% M/M and down 19.7% YOY and are trending down.

Category: Cab, Trailer & Body, Equipment, Featured, General Update, News, Products, Vehicles