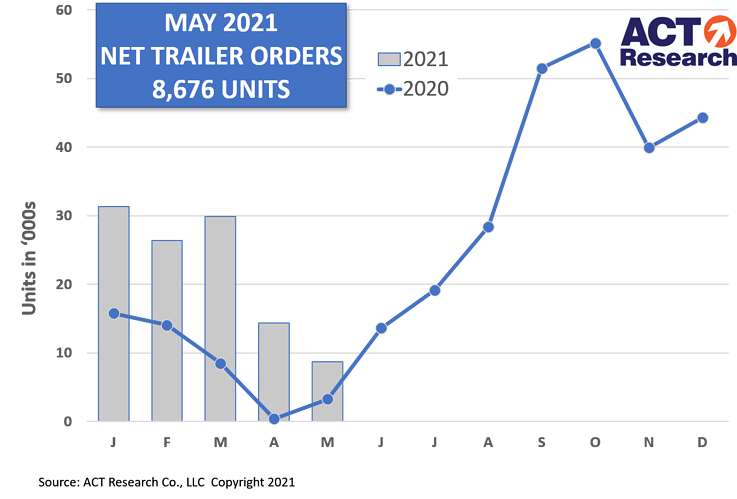

ACT Research: U.S. Net and New Trailer Orders Show Double-Digit M/M Decline

Y/Y Gains Bolstered by COVID-Impacted May 2020

May net US trailer orders of 8,676 units fell nearly 40% from the previous month, but were more than 165% higher compared to the COVID-impacted May of 2020. Before accounting for cancellations, new orders of 11.7k units were down 38% versus April, but 56% better than the previous May, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

“The pause in order acceptance by several trailer OEMs, as they seek to reign in the backlog to an acceptable length, is obviously the driving force. A lack of demand is certainly not a factor. As noted in ACT Research’s recent Classes 5-8 State of the Industry Report, the US Tractor Dashboard for June, which measures the potential strength of the tractor market, rose to its maximum value of 15, an indication of the strong conditions present across the entire commercial vehicle market,” said Frank Maly, Director–CV Transportation Analysis and Research at ACT Research. He cautioned, “Orders will again begin to flow once OEMs are satisfied that materials/component pricing and supply, along with adequate staff, are in place to allow them to make further 2022 production commitments and satisfy robust fleet demand.”

Maly added, “The ongoing challenge for OEMs to ramp production in response to robust fleet demand is evident in the backlog-to-build metric, which has ranged between 9 and 11 months since December. May closed at 9.1 months, the result of lower net orders being booked, backlog reduction, and a small increase in the build rate.” He concluded, “Even with that backlog-to-build ratio decline, the industry is committed, on average, into March of 2022, with dry vans and reefers extended to April and into May, respectively.”

Category: Cab, Trailer & Body New, Equipment, Featured, General Update, News, Vehicles