As Holidays Approach, Reefer Freight Heats Up

DAT Trendlines: Freight Trends on the Spot Market

The number of available loads of spot truckload freight fell 8% while truck posts jumped more than 11% during the week ending Nov. 15, said DAT Freight & Analytics, which operates the industry’s largest network of load boards.

Van, refrigerated, and flatbed load-to-truck ratios each fell by double digits, although loads of fresh and frozen food are abundant during the lead-up to Thanksgiving. Load-to-truck ratios measure the number of available loads relative to the number of available trucks on the DAT network and indicate shifts in demand and spot truckload pricing.

The national average van ratio was 4.2, down from 5.2 the previous week, while the reefer ratio was 9.8, down from 11.75. The flatbed load-to-truck ratio declined from 34.4 to 28.5.

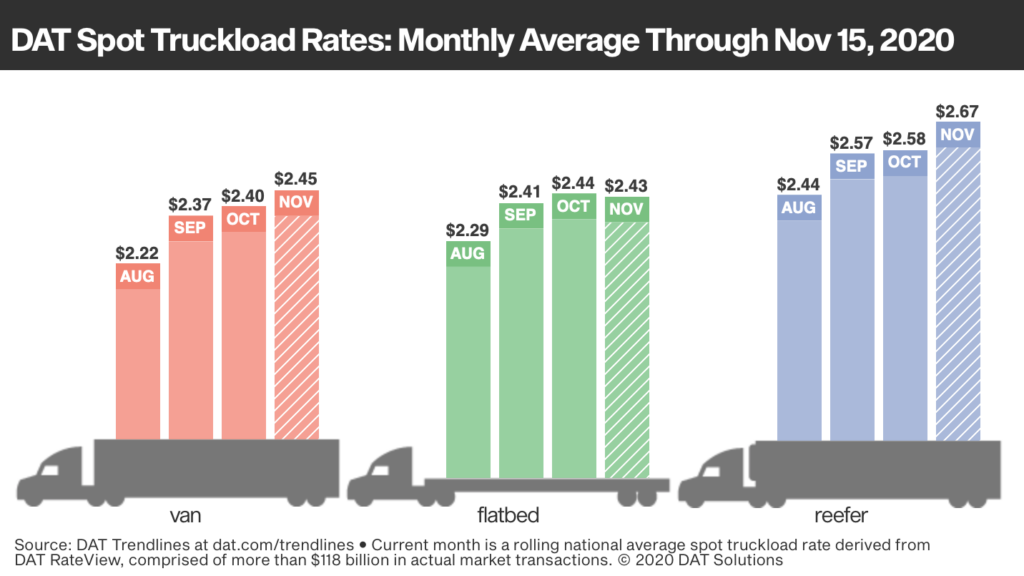

National Average Rates

Fewer loads and more trucks usually means a drop in national average spot truckload rates, but van and reefer pricing improved compared to the previous week.

• Van: $2.45 per mile, up 1%

• Reefer: $2.67 per mile, up 3.6%

• Flatbed: $2.43 per mile, virtually unchanged week over week

These are national average spot rates for the month through Nov. 15. These averages are derived from DAT RateView, the industry-standard resource for truckload pricing with $118 billion in actual freight transactions.

Trends to Watch

Turkeys trot

On DAT’s 72 highest-volume lanes for refrigerated freight, the average spot rate was higher on 51 lanes, 17 lanes showed no significant change, and just four lanes were lower. Volume on these lanes was up 7.4% compared to the previous week on the strength of food and beverage freight, which is up 95% year over year.

In the days leading up to Thanksgiving, capacity tends to tighten especially in Midwest markets where there is a heavy concentration of turkey farms, feed sources, and processing plants.

Turkey sales (whole birds and cuts) are up with shoppers buying turkey four times more often this year than in 2019. Compared to the national average reefer rate, rates in the five leading turkey-producing states—North Carolina, Minnesota, Arkansas, Missouri, and Indiana—were up 23 cents a mile last week.

Van freight moves inland

Outbound volumes from Los Angeles were down 13% and from Ontario down 7% week over week. That’s good news because it indicates that the surge in imports that has snarled ports in Southern California and elsewhere on the West Coast is finally moving inland.

The average spot rate was higher on 42 of DAT’s top 100 van lanes by volume. Twenty lanes were neutral and 38 saw rates fall. Notably, the number of inbound loads to Memphis—a major distribution hub for retail goods—was up 8% compared to the previous week.

While the national average van load-to-truck ratio declined last week, the spot market continues to produce opportunities for truckers. Freight volumes are up 67% with 5% fewer trucks posted for loads compared to the same week in 2019.

Home sales and flatbed freight

A good signal of demand in the flatbed sector is the Fannie Mae Home Purchase Sentiment Index (HPSI). While it inched up slightly to 81.7 in October, the third consecutive month of increases, the HPSI is down 7.1 points year over year. The survey-based report indicates that consumers are more optimistic about both home-buying and home-selling conditions, but are pessimistic about their personal finances and employment outlook.

Flatbed freight continues to cool with volumes down 7% week over week in DAT’s top 10 flatbed markets. Volumes from Little Rock, the No. 1 market, plummeted by 26% week over week.

Nationally, a 7% decrease in flatbed load posts and 9% increase in truck posts provides no evidence of upward rate pressure.

DAT operates the industry’s largest network of load boards and data analytics service. Rates are derived from DAT RateView, a database of $68 billion in actual spot market transactions each year. DAT monitors an additional $50 billion in contract freight transactions for subscribers to its Freight Market Intelligence Consortium (FMIC).

DAT doesn’t set spot rates—each transaction is individually negotiated between the carrier and the broker or shipper and will vary from load to load and lane to lane.

Category: Featured, General Update, News