Average New-Vehicle Prices Up 2% Year-Over-Year in April 2020

Helped by Available Incentive Offers from Automakers and Finance Companies

Non-Luxury Brands, Car Segments See Most Growth as Buyers Take Interest in More Budget-Conscious Vehicles

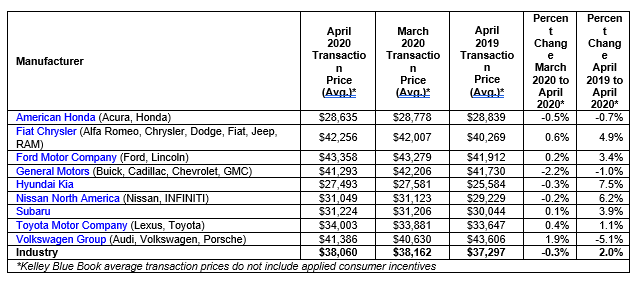

The valuation analysts at Kelley Blue Book today reported the estimated average transaction price for a light vehicle in the United States was $38,060 in April 2020. New-vehicle prices increased $763 (up 2.0%) from April 2019, while prices dropped $102 (down 0.3%) from last month.

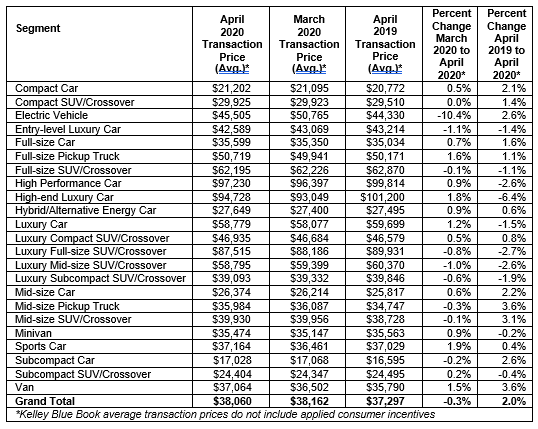

“Although auto sales are expected to drop more than 50% in April, average transaction prices held steady from the earlier months of the year and rose by 2% year-over-year, likely helped by the abundant incentive offers enacted by automakers and finance companies in March of this year,” said Tim Fleming, analyst for Kelley Blue Book. “We observed a bit of a shift in the data this month as more price conscious segments increased more than normal. Car segments that were flat earlier this year showed increases across the board in April. At the same time, luxury segments took a dive, down nearly $1,500 from this time last year, as buyers shied away from these fast-depreciating models.”

Hyundai Kia continue to lead all manufacturers in terms of pricing growth behind Hyundai’s 12% improvement. All Hyundai models showed gains year-over-year, with none higher than the redesigned Sonata’s 17% jump. The new Sonata now has the highest average transaction prices in the midsize car segment, whereas in April 2019 it was in the last place. Perhaps helped by the Sonata, the recently refreshed Elantra also saw a spike as it rose nearly 7%. Kia’s gains were not as significant as the brand’s average price climbed 3%. The Telluride, now facing year-over-year comparisons, led the brand with 10% growth as its trim mix skewed more towards the top-end SX. Kia’s best-selling model, the Optima, managed a 1% improvement in its last year before being redesigned.

Nissan North America also saw strong average transaction price increases in line with Q1 results, led by the Nissan brand’s 7% gains. Perhaps surprisingly in today’s SUV and truck-heavy market, Nissan was led by its cars. The redesigned Versa had the biggest jump, up 17%, and the new Sentra continues to rise each month, up 7% in April 2020.

On a segment level, cars saw the biggest increase at 2% year-over-year. In fact, all the non-luxury car segments saw increases in the 2% range, a change from recent months where cars were trending roughly flat. This may show buyers taking more interest in these more budget-conscious segments. Another sign of shifting preferences in April 2020 is at the brand level. Luxury brands were down 2.5%, while non-luxury brands rose 4%. Nearly all luxury segments saw declines, while only one non-luxury segments was noticeably down (full-size SUVs). Mid-size trucks showed the biggest improvement year-over-year, due in large part to the Jeep Gladiator.

Category: Featured, General Update, News, Vehicles