Best Recession Ever for Class 8 Trucking

ACT Research reports healthy sales and build trends for Class 8 into 2023

In spite of what seems to be a stumbling freight picture, higher financing costs, and increasingly restrictive credit availability, ACT continues to see healthy sales and build trends for Class 8 into 2023. Pent-up vehicle demand and still elevated carrier profits in early 2023 continue to provide a supportive environment for new equipment, ACT’s latest release of the North American Commercial Vehicle OUTLOOK reported.

According to Kenny Vieth, ACT’s President and Senior Analyst, “We continue to expect a recession in the first half of this year leading to an incremental year-over-year decline in 2023 Class 8 build from 2022 as freight market weakness increasingly weighs on demand into the year’s second half.” He added, “While the Fed may continue raising interest rates in 25-basis point increments longer into 2023 than currently envisioned, we do not believe the pace of rate hikes will be aggressive enough to sharply impact commercial vehicle market performance.”

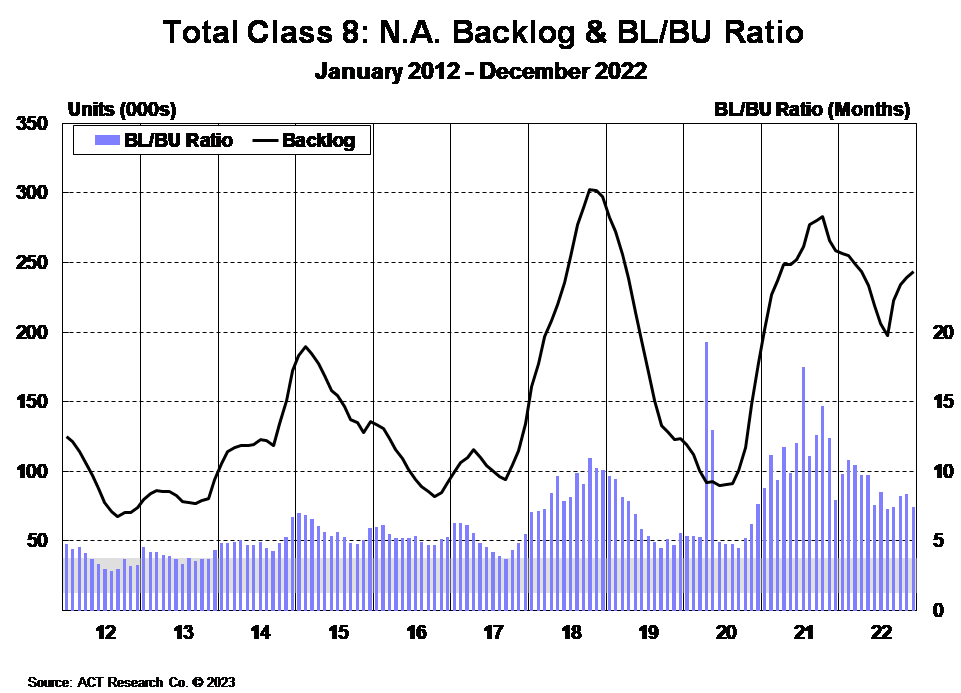

“The industry enters 2023 with a fair amount of visibility, thanks to a robust backlog,” Vieth concluded. “While down year-over-year, the December-ending Class 8 backlog represents the fourth highest year-end backlog on record. With this as context, our call for strong production in 2023 is hardly a stretch. That said, we do expect softening, as lower freight volumes and rates, higher costs, improved equipment availability, and the gradual exhausting of pent-up demand begin to exert downward demand pressure.”

Category: Featured, General Update, Management, News, Transit News, Vehicles