Class 8 Truck Orders at 11,600 Units in April, down 27% Y/Y

ACT Research reports April orders were weaker than expected on a standalone basis

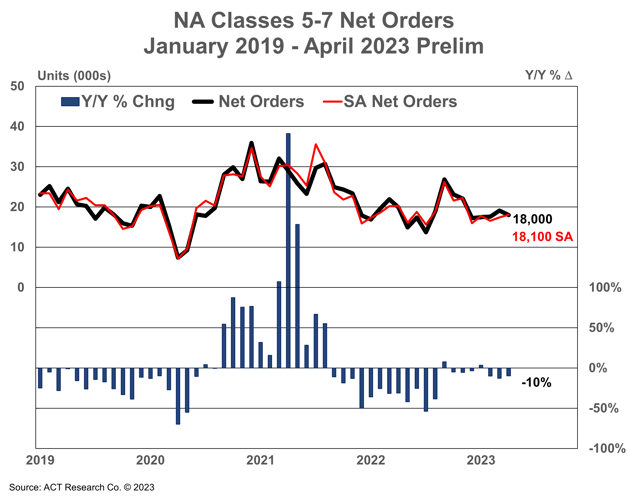

Preliminary NA Class 8 net orders in April were 11,600 units, down 27% y/y (-39% m/m), while preliminary Classes 5-7 net orders were 18,000 units, down 10% y/y (-6% m/m). Complete industry data for April, including final order numbers, will be published by ACT Research in mid-May.

“Given robust Class 8 orders into year end, ensuing backlog support, and normal seasonal order patterns, orders were expected to moderate into Q2; we expected SA orders in a range of 15-20k units per month into mid-Q3’23. Coupling those items with increasingly cautious readings from the ACT Class 8 Dashboard, April orders were weaker than expected on a standalone basis but bring the ytd monthly SA average to 17,500, squarely in line with our view,” shared Eric Crawford, ACT’s Vice President and Senior Analyst. “The recent turmoil in the banking sector likely tightened credit conditions for some industry participants and may have played a factor in exacerbating April’s weakness. Thus, while we expect orders to remain at subdued levels into mid-Q3’23, we are not inclined to think April’s order activity represents the likely run rate going forward.”

He added, “Medium-duty demand declined y/y by single digits, moderating after two straight months of double-digit declines. April Classes 5-7 orders declined 10% y/y (-6% m/m) to 18,000 units.”

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Vehicles