ComFreight Ventures into Freight Factoring

ComFreight, a leading load board and freight marketplace for carriers, shippers and brokers, is getting into the factoring business — purchasing accounts receivables at a discount — with a technology that it says is “now capable of completely managing the digital payment advance process for carriers’ hauls using any device.”

Steve Kochan, ComFreight’s CEO and Co-Founder stated, “For many small-to-medium-sized trucking companies, cash flow is most important. Carriers work extremely hard to earn quick and immediate payments from their customers. We want to be the first to make the process of requesting an advance on any invoice seamless, digitally on-demand and fully integrated with the other most important part of our user’s day-to-day activities – finding loads.”

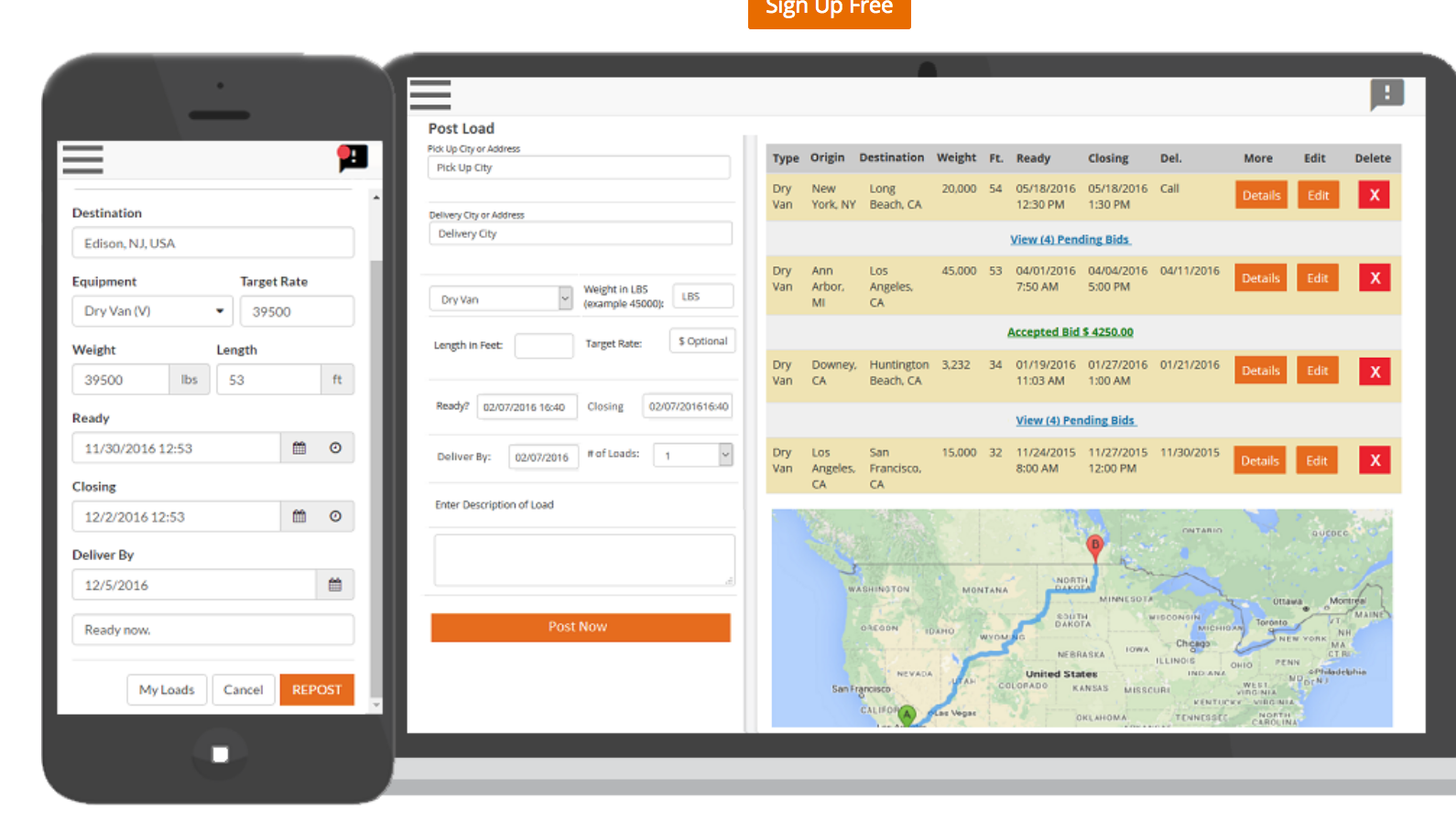

ComFreight’s Marketplace enables any authorized carrier to apply for factoring using its quick 3-step digital sign up process. ComFreight’s streamlined application and fully-digitized approval process occurs within minutes using any device – and in one session.

Once approved, users gain full access to ComFreight’s web-enabled / mobile Haul Pay application. ComFreight’s Haul Pay features enable carriers to factor loads on any credit-qualified broker or shipper with whom they transact business – regardless of whether that load originates from its own load board and/or any other source.

However, for credit-qualified loads that do originate from ComFreight’s Marketplace, users simply tap a button to generate a payment request within seconds. This commitment extends even further to new, credit-qualified brokers/shippers whom can apply and be able to factor invoices within one business day. Additionally, all approved Haul Pay users gain free/instant access to other features such as shipper load alerts, load search tools, and market rate trends.

Steve Kochan stated “ComFreight’s program focuses on non-recourse transactions with a flat 3.50% rate. There are no hidden fees of any kind. ComFreight is the load board and the direct factoring company – all rolled up into one. We’ve researched and determined that most companies in our industry market their factoring products as non-recourse with low fees ranging from 1.5% to 3.0%. However, these low fees are riddled with additional / hidden costs, which most carriers unknowingly wind up paying for. This results in anywhere from an 8.2% to as high as a 22.4% factoring fee.Payment arrangements must be straightforward, honest and, most of all, they need to make a factoring company accountable to their customer – it’s that plain and simple”.

Category: Management, News