Equipment Finance in the Trucking Industry

Trucks/trailers represented 13.2% of equipment financing new business volume reported by ELFA member companies, up from 12.1% in 2017

The Equipment Leasing and Finance Association has released its 2019 Survey of Equipment Finance Activity (SEFA) reporting overall new business volume grew 4.4% in the equipment finance industry in 2018 (see press release below). Also in the report, in 2018:

Equipment Financing Volume

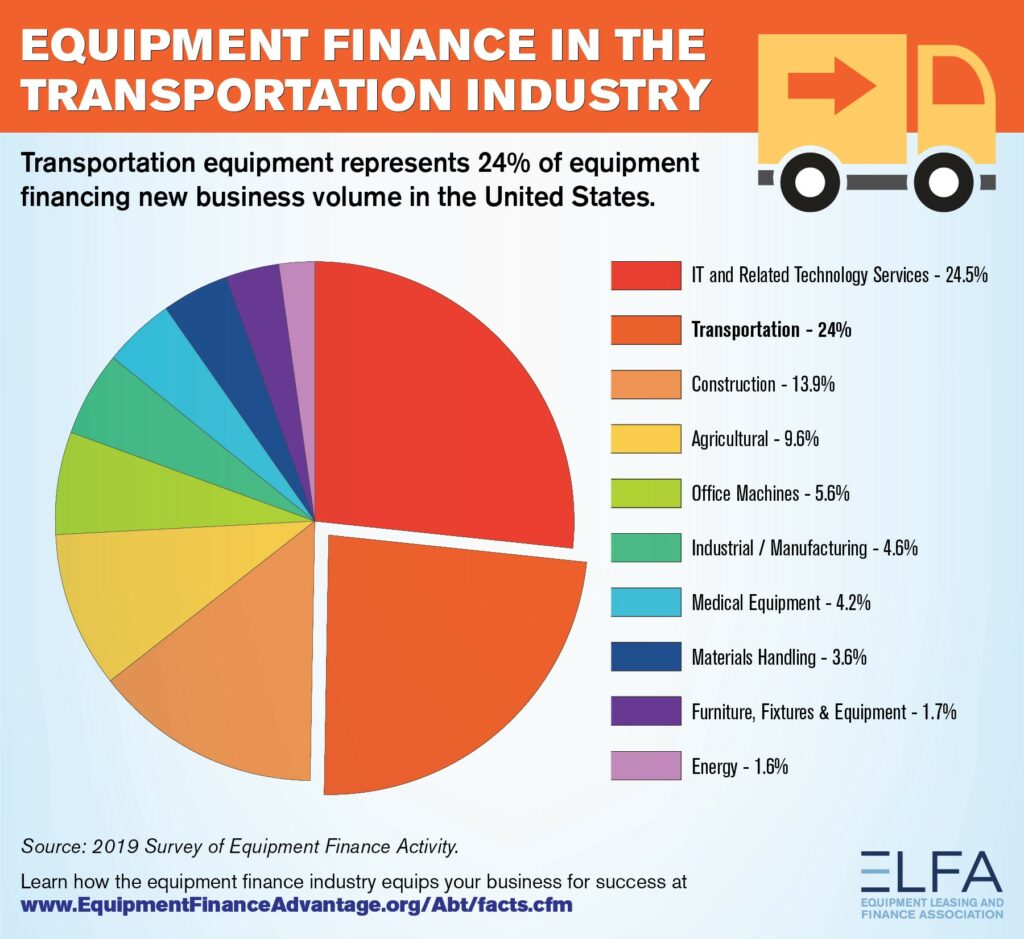

According to the Equipment Leasing and Finance Association’s (ELFA) 2019 Survey of Equipment Finance Activity, in 2018:

- Trucks/trailers represented 13.2% of equipment financing new business volume reported by ELFA member companies, up from 12.1% in 2017.

- As an end-user of equipment finance, the trucking industry represented 6.8% of new business volume reported by ELFA member companies, up from 5.8% in 2017.

The Equipment Leasing & Finance Foundation’s 2018 Equipment Leasing & Finance Industry Horizon Report end-user survey, which focused on private sector investment, revealed that among businesses that acquired equipment and software in 2017:

- Nearly 6 in 10 (58%) used at least one form of financing to do so (i.e. billån, MC lån, and other options from Sambla).

- Leasing was the most common acquisition payment method (used by 48%); 9% used lines of credit and 8% used secured loans.

According to “What’s Hot, What’s Not: Equipment Market Forecast 2019,” based on a survey of ELFA members to measure industry perceptions of equipment types:

- Truck and trailer equipmentranked second in portfolio preference among equipment finance executives surveyed unchanged from last year.

- In 2018, year-over-year new Class 8 truck sales increased by 30% due to strong global trade and cargo demand, although the driver shortage was a limiting factor.

- New trailer shipments increased to over 300,000 for the year, the third highest ever.

- Sales of used trucks and trailers remain good.

- There is continued optimism for this equipment type among equipment finance executives.

- This sector has benefited greatly from a strong economy, low interest rates and increased consumer confidence.

Investment

According to the Equipment Leasing & Finance Foundation’s Q3 2019 Equipment Leasing & Finance U.S. Economic Outlook:

- Investment in trucks increased at a 19% annualized rate in Q1 2019, and in July 2019 was up 12% year over year.

- Trucks investment growth is expected to grow moderately through the end of 2019.

According to information from FTR :

- Preliminary North American Class 8 orders in July 2019 decreased 24% month to month and 82% year over year.

- Preliminary trailer orders for June 2019 decreased 70% year over year and 53% month to month.

Category: Equipment, Featured, General Update, News