Faster inventory replenishment cycles expected in 2023; depot space to remain tight and operational costs to remain elevated

Holiday season to hit early exhaustion of inventories; retailers might end up replenishing their fresh inventories sooner than expected

The holiday season, now at its peak, is going to trigger an early burn-out of inventories in the US, which resultantly will kickstart the inventory replenishment cycles a bit sooner than the supply chain and shipping industry predicted earlier this year. This would cause an increase in demand in the export hubs as the US starts to work on balancing its order-to-inventory ratio, as discussed in a recent webinar hosted by Container xChange, the leading online container logistics platform for container trading and leasing globally.

The webinar shed light on some of the pertinent challenges faced by the container logistics industry worldwide and discussed some of the market trends likely to appear in the industry.

Global trade is undergoing an opportune shift in supply chain reliance on China to newer emerging SE markets as the country tightens its zero covid policy and struggles with increasing labour costs amidst other market disruptions. Furthermore, China has grown out of the low-cost countries (LCC) label, which has made way for other southeast Asian countries like India, Singapore, Vietnam, and Malaysia to mark their presence into multinational companies’ long-term regional presence imperative.

Predicting how the trade volume shift might look like in 2023, Mr. Eric Johnson, Director at S&P Global and Senior Technology Editor at JOC.com said, “There is an evident drop in trade between China and the US and the UK, and one of the major trends that have caught the attention of the supply chain and shipping industry is that imports from China to the US and UK have gone down. However, import volume into the US as a whole from all regions hasn’t gone down at the same rate as from China specifically which strongly corroborates the trade shifting elsewhere.”

Companies globally are focusing on creating regional alternatives to curb supply chain disruptions cropping up due to high labour costs, fresh lockdowns in the country and protests in the country.

With the dramatic fall in consumer demand, and with more containers available, the spot rates on transpacific routes between some countries in East Asia and the US have dropped drastically as well.

The spot rate of a 40 ft container in the China-West Coast route fell by 20% to $2,361 in October. The typical premium rate a year back was $20,000. Across the Atlantic, shippers in the US have witnessed a 20% dip in ocean freight orders, and ocean carriers have cancelled half of their sailings to make sure that their vessel’s capacity matches the demand.

One-way pickup charges for standard containers from China to North America are declining month on month since May 2022 from $1773 to $344 in October. (One-fifth of what it was in May)

One-way pickup charges from China to Europe declined from $2845 in January 2022, to $1726 in May 2022 and further to $910 in October

One-way pickup charges declined by 80% from $1773 in May to $344 in October over the past 6 months at the China-North America stretch and a 47% decline on the China-to-Europe stretch

China continues to see a fall in freight rates

According to Container xChange platform data, the average container prices and one-way leasing rates in October 2022 on Asia to the US East Coast and the West Coast were respectively 63% and 85% lower than the rates in October 2021. However, while the rates have dropped dramatically in 2022, if we compare them with the rates in October 2019 instead, the drop is not as surprising.

“The supply chain is already in distress with a surplus of containers, maxed out depot space and an increase in blank sailings. The Zero covid strategy and the geopolitical and trade risks in China will further contribute to the drop in demand for containers in China,” said Christian Roeloffs, cofounder and CEO, of Container xChange.

However, it also means that the demand will slowly stabilize and get closer to the level at which it was before the pandemic started. We also expect the capacity re-adjustments to continue. Especially in the Trans-Pacific Lane, the demand will continue to decline. In fact, by November end, West Coast spot rates might even drop below $2,000.” Christian added.

Container xChange’s data shows that not just has the price of the containers decreased but there also is a drastic decline in the pickup charges. The average one-way pickup (PU) rates for 40 ft HC boxes from China to the US have seen a steep decline since June 2022 from $2,109 in May to a surprising $606 in September.

CAx (Container availability Index) * values are much higher than pre-pandemic – meaning that the inbound containers are significantly higher at the Chinese ports than the imported boxes this year as compared to 2019 (pre-pandemic) and since then. This indicates that there are not as many containers leaving the ports from China which is now obvious and evident considering the uncertainties looming onto the China shipping business.

Countries and businesses show candour towards minimizing dependence on linear supply chains

“We will continue to see efforts towards diversification of supply chain sourcing and manufacturing out of China. This is a long-term view, and it will need vision and strategy from companies looking for a more resilient supply chain. We will witness increased container volumes intra-Asia and more countries will emerge as potential alternatives like Vietnam, India and more. In such an environment where there will be tighter margins for freight forwarders and traders, the cost is going to be everything. Leaders will look for ways to efficiency and business sustenance.”

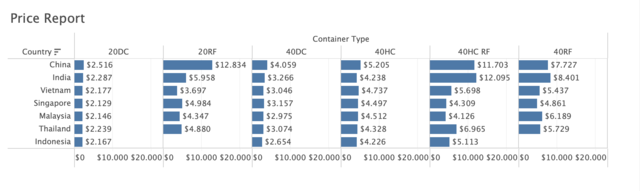

Comparing the container prices in the Southeast Asian countries with that of China, the container prices are considerably lower in Indonesia, Thailand, Malaysia, Singapore, Vietnam and India than that China which corroborates well with the SE countries being opted as China plus one alternative.

Container xChange Platform Data

The concepts of “minimization of logistics risks” and “diversification of supply chain” are not new. Countries and businesses are working harder than ever to eliminate their supply chains’ excessive reliance on just one market. As part of a China plus one strategy, businesses are currently assessing and launching projects to test the waters by entering into fresh countries to meet their supply chain demands.

The speed of this diversification is actually closely correlated with the additional disruptions we will observe in China as a result of numerous variables, including the Zero COVID plan, additional production shutdowns, and escalating geopolitical tensions. If they happen more quickly, diversification will follow suit.

About Container xChange

Container xChange is a technology company that offers a container trading and leasing platform, payment infrastructure and efficient operating systems to container logistic companies worldwide. Covering the entire transaction process of shipping containers starting with finding new partners to tracking containers and managing payments, xChange makes using 3rd party equipment as easy as booking a hotel. We are on a mission to simplify the logistics of global trade.

Being one of the top ten logistics tech companies globally, xChange is fundamentally transforming thousands of processes involved in moving containers globally. xChange is trusted by more than 1000 container logistics companies including Kuehne+Nagel, Seaco or Sarjak that use our neutral online platform to remove friction and create economic opportunity.

Category: Equipment, Featured, General Update, News, Transit News