Flatbed freight market jumps as vans, reefers level out

DAT spot truckload market pricing trends, week ending March 21, 2021

Flatbed freight market jumps as vans, reefers level out

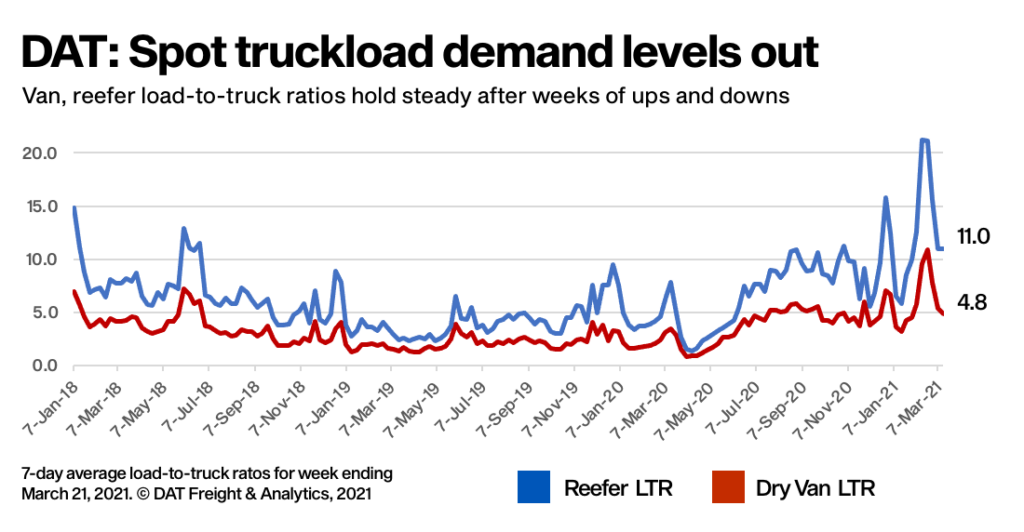

Truckload van and refrigerated freight volumes leveled off while the flatbed load-to-truck ratio jumped sharply last week, said DAT Freight & Analytics, which operates the industry’s largest load board network. The total number of loads posted to the DAT network increased 0.7% and the number of trucks dipped 1.3% week over week; rates held steady for van and reefer freight while flatbed pricing reflected strong demand for trucks.

National Average Spot Rates, March

– Van: $2.68 per mile, 28 cents higher than the February average

– Flatbed: $2.73 per mile, 17 cents higher than February

– Refrigerated: $2.94 per mile, 25 cents higher than February

These are national average spot truckload rates for the month through March 21 and include a calculated fuel surcharge. The national average price of diesel was $3.19 a gallon last week, up 1.6% week over week.

Flatbed loads keep building: Flatbed load post volumes continue to build as construction activity and manufacturing pick up. The national average flatbed load-to-truck ratio was up from 77.6 to 86.5 last week and the average spot rate increased on 41 of DAT’s top 78 flatbed lanes by volume. Twenty-three lanes were neutral and 14 lanes declined compared to the previous week.

Flatbed lanes to watch: The country’s high-volume flatbed lane last week was Lakeland, Fla., to Miami, averaging $3.13 a mile, down 2 cents week over week. That’s better than the average outbound rate from Lakeland, $2.42 a mile. Houston to Dallas averaged $2.77 a mile, up 11 cents compared to the previous week and 14 cents higher than the average outbound rate from Houston. Los Angeles to Phoenix jumped 9 cents to $3.40 a mile while Phoenix to Ontario was up 20 cents to $2.70 a mile.

For van carriers, pricing power remains solid: While rates are high for the time of year, data indicates a plateau in demand for trucks. Rates were lower on 55 of DAT’s top 100 lanes and higher on 24 lanes, and overall volume on those 100 lanes was up just 1% week over week. The national average van load-to-truck ratio fell from 5.4 to 4.8.

Van lanes to watch: The spot van rate from Los Angeles to Stockton averaged $3.60 a mile last week, 5 cents more than the previous week and up 24 cents compared to the last week of February. For all outbound loads, Los Angeles averaged $3.27 a mile, down 5 cents compared to the previous week. Allentown, Penn., to Boston averaged $4.98 a mile and has lingered around $5 for the last four weeks. The jump in rates from Memphis to Charlotte, N.C., outpaced all major van lanes with an increase of 23 cents to $3.41 a mile last week. All told, Memphis averaged $3.35 a mile outbound for spot van freight last week.

The reefer load-to-truck ratio was unchanged at 11.0: The number of loads moved on DAT’s top 72 reefer lanes by volume was up 2.7% compared to the previous week. The average rate was higher on 36 of those lanes, neutral on 16, and lower on 20 lanes.

California continues to drive the reefer market: Los Angeles outbound averaged $3.88 a mile on a 4.7% increase in volume compared to the previous week while Ontario averaged $3.63 per mile on 8.7% more volume. Stockton averaged $3.22 a mile, a 13-cent increase week over week on 6.7% more volume.

Reefer lanes to watch: Two major ports for temperature-controlled goods, Philadelphia and Elizabeth, N.J., are producing strong rates to Boston. Elizabeth to Boston averaged $6.05 a mile, a 15-cent increase week over week, while Philadelphia to Boston averaged $5.24 a mile, up 10 cents on similar volume. Atlanta to Lakeland averaged $3.88 a mile, a 10-cent increase compared to the previous week. Load volumes from Tucson, Arizona, tumbled 7% and the average outbound spot rate fell 13 cents to $2.86 a mile.

Category: Connected Fleet News, Driver Stuff, Featured, News, Vehicles