FTR’s July Trucking Conditions Index Improved from June but Remains in Solidly Negative Territory

Overall truck freight market remains unfavorable for trucking companies

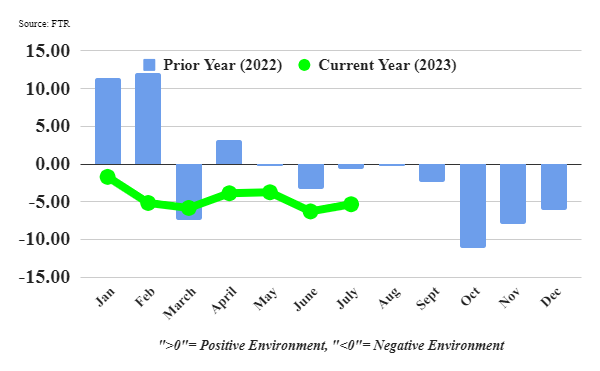

FTR’s Trucking Conditions Index was slightly less negative in July at -5.34 than June’s -6.29 reading as improved freight volume and capacity utilization offset weaker freight rates and higher fuel costs. Carriers continue to face challenging market conditions, and surging fuel prices in August and September will send the TCI even lower in the near term. Aside from fuel cost volatility, the outlook for trucking conditions is little changed with only gradual improvement toward neutral readings by the third quarter of 2024.

Avery Vise, FTR’s vice president of trucking, commented, “The overall truck freight market remains unfavorable for trucking companies, but the financial situation for smaller carriers in particular is tightening due to surging diesel prices. Large numbers of small operations are exiting the market, and that exodus could accelerate if diesel prices continue to rise sharply. So far, the data suggests that larger carriers have absorbed much of that driver capacity, but truckload carriers are approaching a saturation point due to sluggish freight demand. Declining driver capacity could tighten the market modestly, but significant improvement for carriers will require stronger volume as well.”

Details of the July TCI are found in the September 2023 issue of FTR’s Trucking Update, published on August 31. The September edition includes commentary analyzing the ongoing decline in the for-hire carrier population. The Trucking Update includes data and analysis on load volumes, the capacity environment, rates, and the economy.

The TCI tracks the changes representing five major conditions in the U.S. truck market. These conditions are: freight volumes, freight rates, fleet capacity, fuel prices, and financing costs. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.

Category: Connected Fleet News, Equipment, Featured, General Update, Management, News, Vehicles