July Used Retail Sales Decrease in Line with but Greater than Expected

“Sales usually dip a percentage point or two in July, so the decrease was in line with but greater than expectations,” said Steve Tam, Vice President at ACT Research

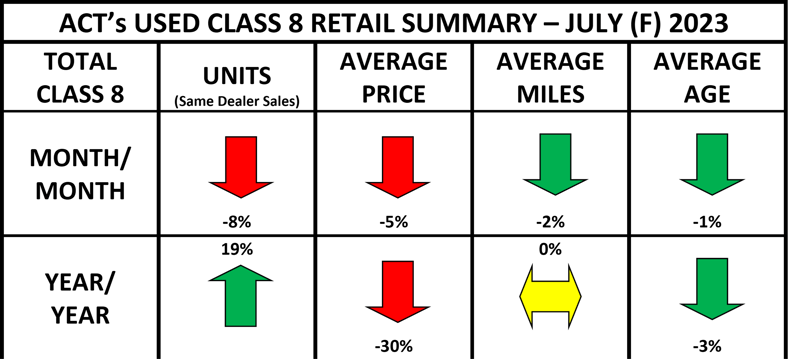

According to the latest State of the Industry: U.S. Classes 3-8 Used Trucks, published by ACT Research, used Class 8 retail sales faltered for the first time in three months in July, declining 7.8% m/m. Average mileage decreased 2%, with average price down 5% and age 1% m/m. Longer term, average volumes jumped 19%, price and age dropped 30% and 3%, respectively, and miles was flat.

“Sales usually dip a percentage point or two in July, so the decrease was in line with but greater than expectations,” said Steve Tam, Vice President at ACT Research. He continued, “Including auctions and wholesales, the total market volume fell 28% m/m in July. Compared to July 2022, the retail market was 19% larger.”

Since July, some clarity has surfaced regarding two potential market-moving situations: “The UPS Teamsters ratified their contract, avoiding a disruptive strike. Closer to home, the bankruptcy of Yellow appears to be progressing in a disciplined, methodical, and orderly fashion. The company owns more than 14,000 trucks (primarily Class 8 day cabs) and nearly 45,000 trailers.”

Tam concluded, “Were all that equipment dumped into inventory at one time, the result conjures up images of a piranha feeding frenzy. While it is still very early in the process and there are no guarantees, this approach should help to minimize the negative impact on used equipment values.”

Category: Cab, Trailer & Body, Equipment, Featured, General Update, News, Products, Vehicles