June Class 8 Truck Orders Increase 5% Y/Y at 16,200 Units

Preliminary NA Class 8 net orders remained seasonally soft in June with 16,200 units

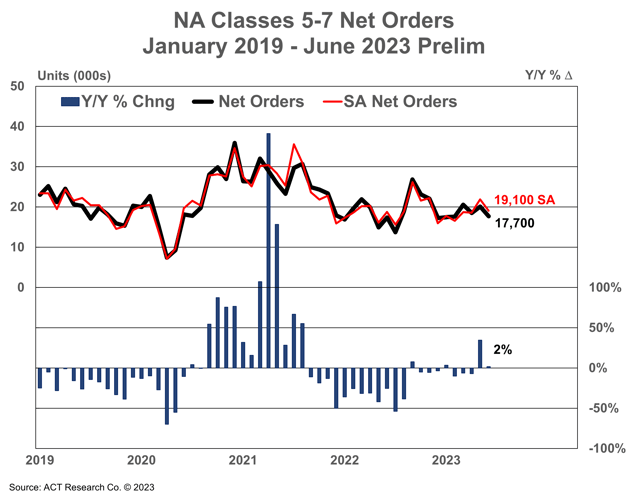

Preliminary NA Class 8 net orders remained seasonally soft (as expected) in June with 16,200 units, up 5% y/y and 4% m/m, while preliminary Classes 5-7 rose a modest 2% y/y with 17,700 units (-12% m/m). Complete industry data for May, including final order numbers, will be published by ACT Research in mid-July.

“Given robust Class 8 orders into year-end 2022 and the ensuing backlog support, coupled with normal seasonal order patterns, orders were expected to moderate into Q2 and remain at relatively soft levels into mid-Q3’23. June orders were in line with this view, bringing the ytd monthly SA average to 18,200,” shared Eric Crawford, ACT’s Vice President and Senior Analyst. “The relatively few build slots still free in 2H’23 suggest order intake is unlikely to find meaningful traction until 2024 orderboards open.”

He added, “Medium-duty demand rose a modest 2% y/y to 17,700 units (-12% m/m). The seasonally adjusted June intake, at 19,100 units, increased 2% y/y (-12% m/m), equivalent to ~229k units on an annualized basis.”

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Vehicles