New Research from WEX and (E) BrandConnect Identifies the Pandemic as a Tipping Point for Digital Payments

COVID-19 transformed the world of work as we know it, and businesses had no choice but to adapt

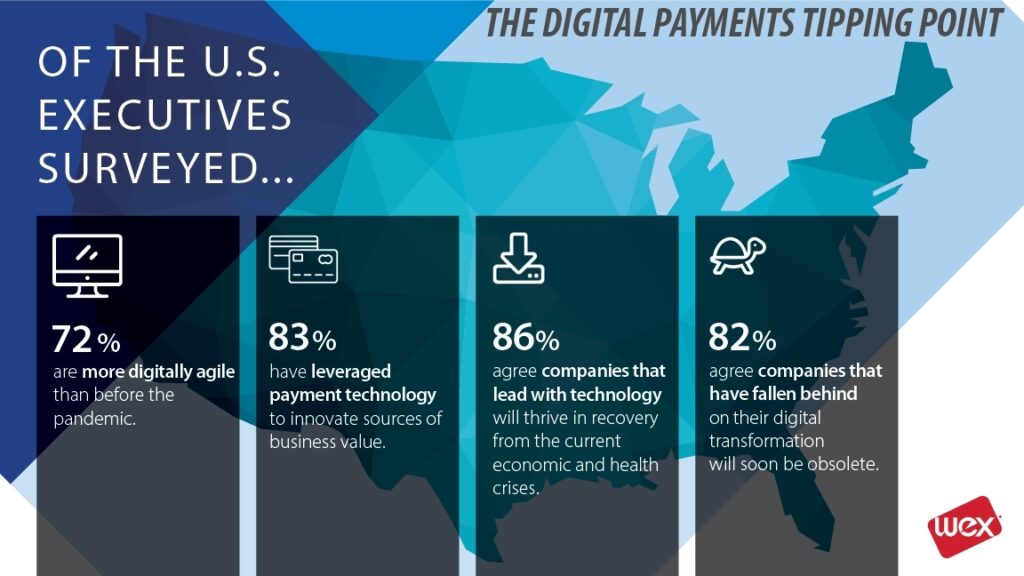

WEX leading financial technology service provider, and (E) BrandConnect, a commercial arm of The Economist Group, today announced the release of “The Digital Payments Tipping Point” white paper, which highlights how the pandemic has accelerated the digital transformation of B2B payments. The survey, of U.S. executives in financial services and technology, found that 72 percent of U.S. executives in those sectors are more digitally agile than before the pandemic and 83 percent have leveraged payment technology to innovate new sources of business value.

As the economy recovers, 42 percent of those executives say they see the need to modernize their technology platforms, given how legacy processes and platforms typically don’t perform as well in a work-from-home environment. And the race is on: 72 percent of the respondents agree that their company needs to transform its end-customer supplier payments solution quickly in order to outpace its competitors.

“COVID-19 transformed the world of work as we know it, and businesses had no choice but to adapt,” said Jay Dearborn, president of WEX Corporate Payments. “In many ways this was a forced transition, but we’ve found that, among our customers and partners, those that are recovering fastest already had a culture of digital transformation instead of relying on legacy processes. Additionally, we are seeing an increased focus on efficiencies and value creation, both from companies making payments and suppliers receiving them.”

When it comes to creating customer value through payments, 83 percent of the respondents agreed that payments innovations could deliver new business efficiencies and sources of revenue in the post-pandemic economy. Priority areas for payments innovation were identified as e-invoicing/e-billing and cutting costs by optimizing payment terms and timing.

The research highlights both the opportunity and challenges in the payments space, painting a stark reality that companies that don’t adapt may not survive. 81 percent of respondents agree that “companies that continue to lag behind on internal technological infrastructure changes will be left behind” and 82 percent agree that “companies that have fallen behind on their digital transformation will soon be obsolete.”

To download the full research report, please visit: paymentsinnovation.economist.com.

Category: Connected Fleet News, Driver Stuff, Equipment, Featured, Fuel & Oil, General Update, News, Tech Talk