New Sandhills Global Market Reports Show Growing Gap Between Asking and Auction Values Across Equipment and Truck Markets

Auction values for heavy-duty trucks dropped 7.4% month-to-month from June to July

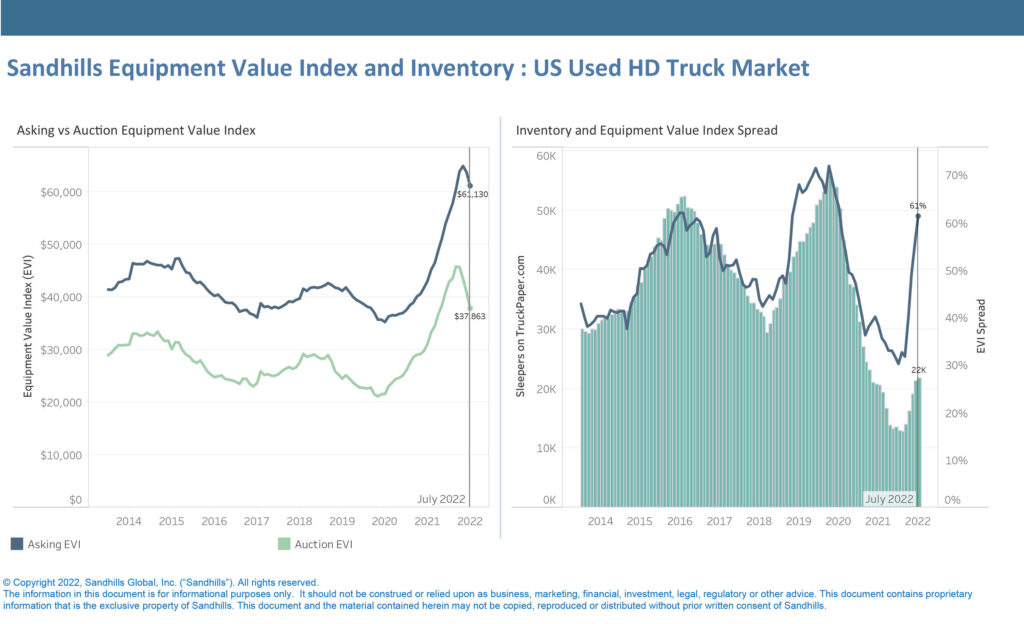

With values in transition across equipment and trucking industries throughout Q2 2022, the newest market reports from Sandhills Global take a deeper look at the growing gap between asking and auction values within Sandhills marketplaces. Data for July shows asking values for heavy-duty trucks and semi-trailers at 61% and 62% above auction values, respectively.

“Fleet truck auction values have dropped significantly from April,” explains Mitch Helman, sales manager at Sandhills Global. “Despite the massive decrease, auction values remain above historic trends and are 22% higher than last July.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

The percentage gap between asking and auction values is quantified in Sandhills market reports as EVI spread. During periods of accelerated EVI spread, such as what Sandhills is seeing now, assessing buying and selling strategies is crucial in order to mitigate risk.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The latest reports examine the EVI spread, focusing on the current trends in heavy-duty trucks and medium-duty construction equipment. Currently, data for July shows the EVI spread for heavy-duty trucks has doubled since March 2022, when the gap was just 30%. Regional variabilities are also identified to showcase value trends in different geographic locations.

U.S. Used Heavy-Duty Trucks EVI and Regional Variability

- Auction values for heavy-duty trucks dropped 7.4% month-to-month from June to July; the auction EVI dipped to $37,863.

- The North East region displayed the biggest EVI spread (66%), along with the largest auction value decrease (8.7% M/M), among U.S. regions tracked by Sandhills.

- The South East region displayed the largest inventory increase from June to July, up 2.7% M/M.

Category: Equipment, Featured, General Update, News, Products, Vehicles