Recovery Continues as June Retail Sales Decline 6% from Pre-Virus Forecast; Transaction Prices Set Monthly Record

“On average, total grosses inclusive of finance and insurance income on new vehicles are expected to reach the highest level ever in June.”

The Retail Sales Forecast

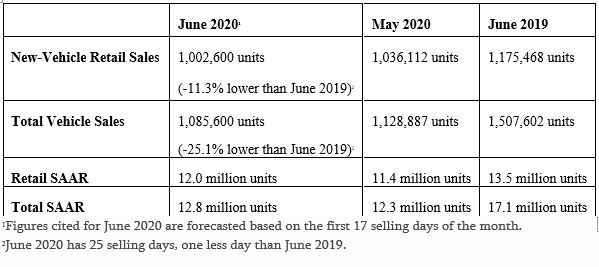

New-vehicle retail sales in June are expected to be down from a year ago, according to a joint forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,002,600 units, a 5.7% decrease compared with the J.D. Power pre-virus forecast and 11.3% decrease compared with June 2019. Reporting the same numbers without controlling for the number of selling days translates to a decrease of 14.7% over last year. (Note: June 2020 contains one less weekend and one less selling day than June 2019.)

The Total Sales Forecast

Total sales in June are projected to reach 1,085,600 units, a 25.1% decrease compared with June 2019. Reporting the same numbers without controlling for the number of selling days translates to a decrease of 28.0% over last year. The seasonally adjusted annualized rate (SAAR) for total sales is expected to be 12.8 million units, down 4.4 million units from a year ago.

The Takeaway

Thomas King, president of the data and analytics division at J.D. Power:

“The industry continues to show signs of recovery in June, with retail sales down only 6% compared with the J.D. Power pre-virus forecast. This represents a significant improvement from May when retail sales were off 20% from the pre-virus forecast. The combination of pent-up demand, states relaxing coronavirus-related restriction and elevated incentives are all providing a tailwind for the industry.” Remarkably, in markets like Detroit (one of the most severely affected areas by COVID-19), retail sales are on pace to exceed 2019 levels.

Record levels of manufacturer incentives for the month of June are supporting the sales recovery. Incentive spending is on pace to reach $4,411 in June, the highest ever for the month and an increase of $445 from June 2019. Incentives on cars are expected to be up $459 to $4,031, with trucks/SUVs up $407 to $4,524.

—–

Transaction prices continue to set records and are on pace to rise by 3.9% to $34,981, the highest level ever for the month of June. Record prices are being supported by the ongoing shift in consumer demand from cars to trucks/SUVs. Car sales are on pace to account for just 24% of new-vehicle retail sales in June, the lowest level ever for the month of June and the third month in a row below 25%. As the industry shifts towards more expensive products, SUV mix is expected to reach a record 56%.

Record prices are helping to offset the decline in sales, with consumers expected to spend $35.1 billion on new vehicles in June, representing a decline of $4.5 billion from last year.

—–

Looking ahead, inventory constraints and any easing of the pent-up demand that is currently elevating sales will be headwinds to the overall sales recovery. “Despite the challenges the industry continues to face, one notable positive for retailers is the strength of margins on new vehicle sales,” King said. “On average, total grosses inclusive of finance and insurance income on new vehicles are expected to reach the highest level ever in June.” Total gross per unit is on pace to reach $1,759, up $414 from last year. Strong per-unit grosses offer some mitigation to June’s sales pace, while also helping retailers maintain operations after experiencing massive business disruption in March, April and May.

Sales & SAAR Comparison

J.D. Power U.S. Sales and SAAR Comparison

The Details

- The average new-vehicle retail transaction price in June is expected to reach $34,981. The previous high for the month of June, $33,603, was set in June 2019.

- Average incentive spending per unit in June is expected to reach $4,411, up from $3,966 last year (the previous record for the month).

- Incentive spending on cars is expected to be up $459 to $4,031, while spending on trucks/SUVs is up $407 to $4,524.

- Consumers are on pace to spend $35.1 billion on new vehicles, down $4.5 billion from June 2019.

- Truck/SUVs account for 75.6% of new-vehicle retail sales through June 21, the highest level ever for the month of June.

- Days to turn, the average number of days a new vehicle sits on a dealer lot before being sold to a retail customer, is 98 days (through June 21). This is up 23 days from a year ago.

- Fleet sales are expected to total 83,000 units, down 74% from June 2019. Fleet volume is expected to account for 7.6% of total light-vehicle sales, down from 22% a year ago.

Global Outlook for First Half of 2020

Jeff Schuster, president, Americas operations and global vehicle forecasts, LMC Automotive:

“COVID-19 has had a profound effect on the global automotive industry, and markets are in varying stages of recovery. China is already exhibiting a V-shaped recovery, while South Korea is expected to be ahead of 2019 on a year-to-date basis through June. The U.S. market is showing relative strength as we head into the second half of 2020. Western Europe, Brazil and India are underperforming, with volume expected to be off at least 40%. Clearly, risk for the remainder of the year remains very high and downward weighted, but there are now reasons to be cautiously optimistic for demand, as a fragile recovery begins to take shape.”

Global light-vehicle sales YTD through May are down 30% from the same period in 2019, but the level is improving from the low of -45% YoY April to -33% YoY May. For the first half of the year, the outlook for global light-vehicles sales is 32 million units, down 13 million units or 29% from the first half of 2019.

Category: Featured, General Update, News, Vehicles