Sandhills Global Market Report Examines Heavy-Duty Sleeper Truck Value Trends and Growing Gap Between Asking and Auction Values

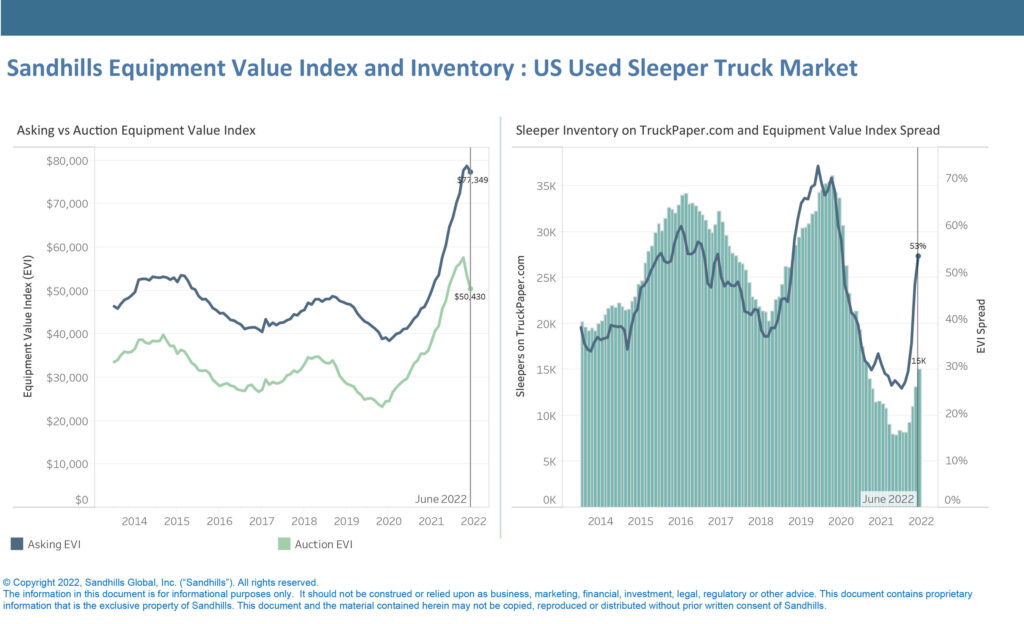

Heavy-duty sleeper truck asking values were 53% higher than auction values in June 2022. June’s EVI spread was up six percentage points from May

Heavy-duty truck values continued to trend downward in June, and latest Sandhills Global market reports focus on the underlying forces influencing the used sleeper truck market. Inventory levels for sleeper trucks have increased month-over-month since this March, and auction values have been dropping since April. Asking values, which are traditionally slower to react to market trends, have now started to descend. Amid these changes, Sandhills market reports show a widening gap between asking and auction values, which serves as another indicator suggesting a further drop in sleeper truck auction and asking values.

he key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

The percentage gap between asking and auction values is quantified in Sandhills market reports as EVI spread. During periods of accelerated EVI spread, such as what Sandhills is seeing now, assessing buying and selling strategies is crucial in order to mitigate risk.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The latest reports examine the EVI spread, breaking down the heavy-duty sleeper truck market by overall trends, by model year and manufacturer, and by asking values across specific model years.

U.S. Used Sleeper Trucks EVI Spread and Inventory

- Heavy-duty sleeper truck asking values were 53% higher than auction values in June 2022.

- June’s EVI spread was up six percentage points from May, marking the fifth consecutive month the EVI spread has widened.

U.S. Used Sleeper Trucks EVI Spread Model Year and Manufacturer

- Sleeper truck age plays a factor in EVI spread, and older models typically have a much wider gap than newer sleeper trucks.

- Sleeper trucks produced in 2019 displayed a 35% gap between asking and auction values, while 2016 model year sleeper trucks displayed a 57% EVI spread.

U.S. Used Sleeper Trucks Asking EVI

- Although used sleeper truck asking values are still above June 2021 figures, all model years displayed M/M declines.

- The Sandhills EVI shows asking values for 2019 model year sleeper trucks were down 10% M/M with an average value of $131,000.

- Asking values for 2016 model year sleeper truck were down 7% M/M with an average value of $75,000.

Category: Equipment, Featured, General Update, News, Products, Vehicles