Sandhills Global Market Reports Track Declines Across Used Truck and Trailer

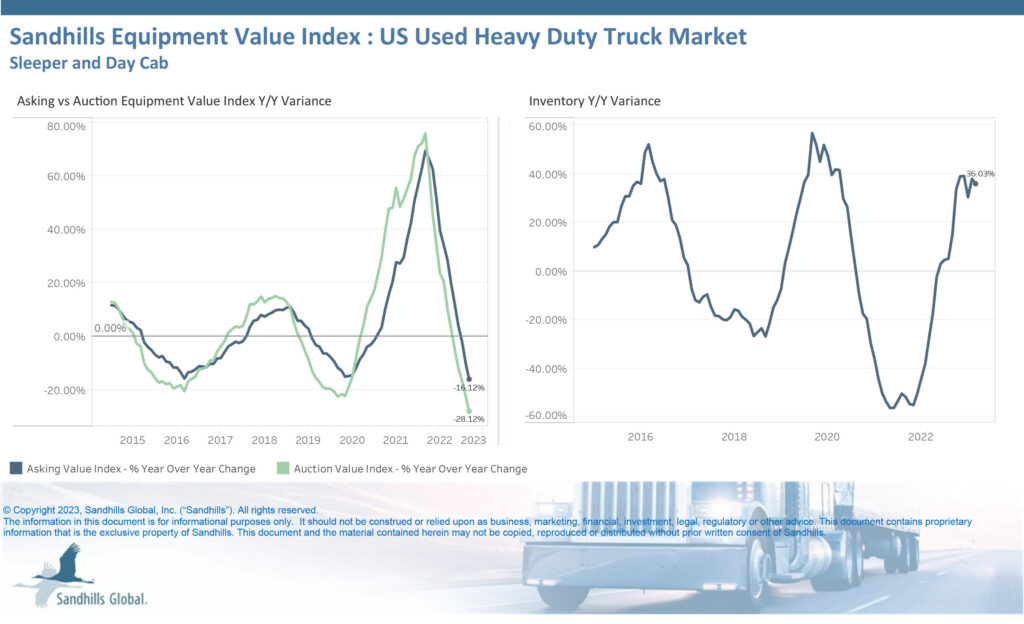

Used heavy-duty truck inventory increased 36.03% YOY

Downward value trends continued in March across Sandhills Global marketplaces. Used truck and trailer values have been in almost non-stop decline for a year, while used construction equipment values remained in a cooling pattern that began in Q3 2022. The most significant change in March occurred in used farm equipment, where inventory is rising and auction values are declining, both historical precursors to declines in asking values.

“With values hitting record numbers across the board in 2022, market value corrections were bound to happen,” says Sales Manager Mitch Helman. “On the retail side, now is a great time for sellers to be more aggressive with pricing strategies, especially for units that they’d like to move quickly. There’s still time to move construction and farm equipment while the overall values remain elevated. Truck and semitrailer sellers should also stay aggressive with pricing as values continue their downward trends.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model year equipment actively in use.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Each report includes detailed analysis and charts that help readers visualize the data. The newest reports examine year-over-year variance in detail, noting changes from March 2022 to March 2023 with an eye to inventory, asking value, and auction value trends.

U.S. Used Heavy-Duty Trucks

- Used heavy-duty truck inventory increased 36.03% YOY, and inventory levels accelerated month to month, jumping 5.4% from February to March.

- Since heavy-duty truck values reached all-time highs in March 2022, asking and auction values have been in nearly continual decline. Asking values dropped 16.12% YOY and auction values are 28.12% lower than last year.

- The Sandhills EVI shows M/M value declines also occurred, with asking values decreasing 2.12% and auction values down 3.52%.

U.S. Used Semitrailers

- Used semitrailer inventory levels were up 3.9% M/M and 50.08% YOY in March.

- Inventory increases and resulting decreases in asking and auction values were driven by dry van and reefer semitrailers.

- Asking values for semitrailers have been in decline since spring of 2022. In March 2023, asking values decreased 3.27% M/M and 18.6% YOY.

- Auction values have trended down in recent months for used semitrailers, and March auction values were down 7.2% M/M and 31.86% YOY.

U.S. Used Medium-Duty Trucks

- Used medium-duty truck inventory increased 6.01% M/M and 15.21% YOY in March. Inventory levels are currently trending sideways, while asking and auction values have cooled.

- Asking values decreased 0.19% M/M and 4.96% YOY.

- The Sandhills EVI shows auction values have decreased in consecutive months. Auction values were down 0.84% M/M and 11.9% YOY.

Category: Cab, Trailer & Body, Equipment, Featured, Fleet Maintenance, General Update, News, Products, Shop Stuff, Vehicles