Sandhills Market Reports Track Continued Decline in Truck and Trailer Values

Although heavy-duty truck inventory levels increased for the fifth consecutive month in July, the 1.7% M/M increase was considerably lower than previous months’ increases

Recent Sandhills Global market reports identified trends in used medium-duty construction equipment in Sandhills marketplaces, including consecutive months of inventory increases, that signaled potential value changes. In July, medium-duty construction equipment trends continued to swing; inventory growth accelerated and auction values decreased for the second month in a row. Because these trends are precursors of declining asking values, buyers and sellers of skid steers, loader backhoes, mini-excavators, and other medium-duty construction equipment need to assess current strategies in order to mitigate risk.

The latest market data, included in the newest Sandhills market reports, details the continued tumble of truck and trailer asking and auction values. And although inventory levels have begun to settle in heavy-duty trucks and semi-trailers, values are likely to continue decreasing in the near future.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

Chart Takeaways

- Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The latest reports detail the ways in which inventory levels are impacting all three markets, including key distinctions in medium-duty and heavy-duty equipment categories.

U.S. Used Heavy-Duty Truck Market

- Although heavy-duty truck inventory levels increased for the fifth consecutive month in July, the 1.7% M/M increase was considerably lower than previous months’ increases.

- Auction EVI decreased 7.4% M/M, representing the fourth consecutive month of auction value decreases. Heavy-duty truck auction values were still up 22% from July 2021.

- Asking EVI decreased 4% M/M but was still up 42% YOY.

- The value decreases in June and July marked the first back-to-back months of decreasing asking values since Q2 2020.

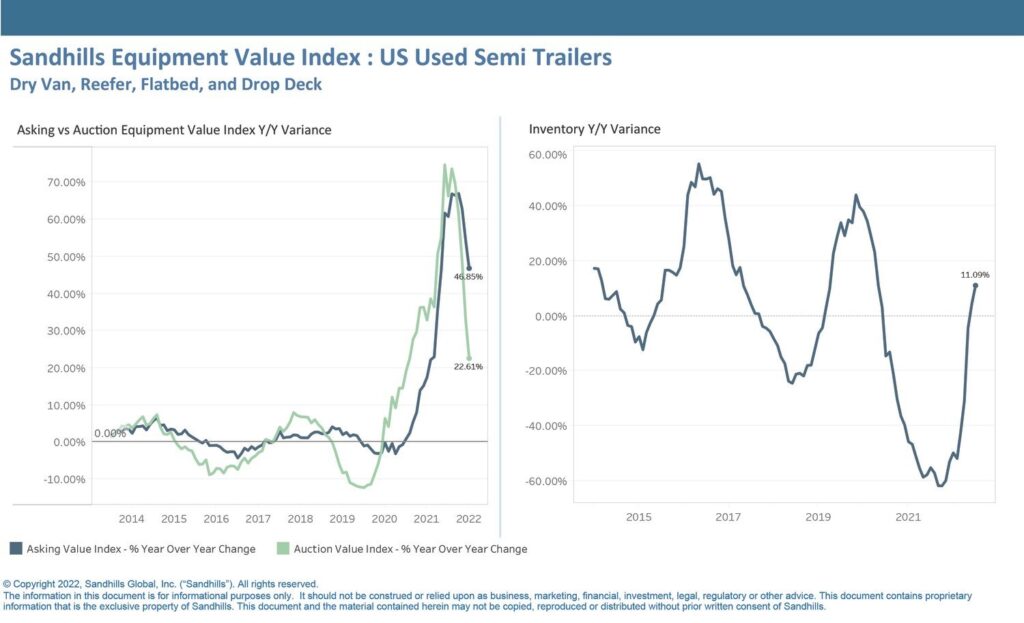

U.S. Used Semi-Trailer Market

- The Sandhills EVI showed inventory levels held steady from June to July and increased 11% YOY.

- Auction EVI for used semi-trailers decreased 3.4% M/M. Similar to the market for heavy-duty trucks, July marked the fourth consecutive month in which auction values decreased. Auction EVI increased 23% YOY.

- With a 2.1% M/M decrease in Asking EVI, semi-trailer asking values decreased in back-to-back months. Asking EVI was still up 47% compared to July 2021.

U.S. Used Medium-Duty Truck Market

- After four consecutive months of inventory increases for medium-duty trucks, July data showed asking and auction values declining after their recent peak.

- Used medium-duty truck inventory increased just 1.2% M/M and was up 31% YOY in July.

- Auction EVI decreased 0.26% M/M and increased 15% YOY; asking EVI decreased 0.15% M/M and increased 27% YOY.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at marketreports@sandhills.com.

Category: Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Transit News, Vehicles