Spot Freight Volumes Continue to Build

Spot truckload rates continued their mid-winter slide last week but freight volumes suggest that pricing should rebound soon

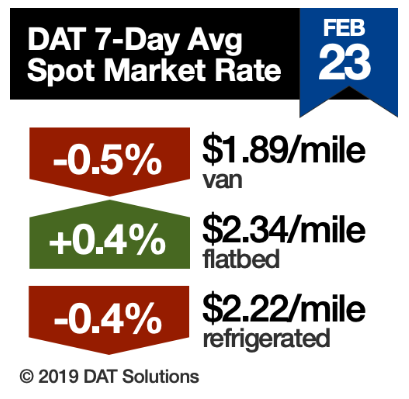

While the overall number of loads posted on the DAT network fell 6% and truck posts were up 3% during the week ending Feb. 23, February van volumes to date are almost 10% higher year over year. Van rates weakened nationally but remained constant in core lanes from top markets, another signal that pricing is starting to firm up. And diesel prices, which are a component of spot rates, are holding in the $2.97 to $3 per gallon range recently after a four-month, 40-cent slide.

VAN TRENDS

The number of van load posts was down 6% compared to the previous week and truck posts were up 4%.

– Load-to-truck ratio (national average): 4.3 van loads per truck

– National average spot van rate: $1.89/mile, down 1 cent

Average spot van rates are 3.6% lower compared to January and down 10.6% from February 2018. Of the top 100 van lanes by volume, pricing fell on 64 lanes.

While the national average rates suggest an “off” market for van freight, volume jumped 13.3% from January to February, the biggest increase between the two months in the past four years. Ocean freight should start to hit U.S. shores in advance of the Spring retail season, and with the next round of tariffs postponed we may see at least the normal seasonal uplift.

Strong volumes and stable rates on key individual lanes continue to suggest that spot van rates are bottoming out.

FLATBED TRENDS

The number of flatbed load posts fell 5% and truck posts were up 2%.

– Load-to-truck ratio: 25.1 flatbed loads per truck, down from 27

– National average spot flatbed rate: $2.34/mile, up 1 cent

Despite lower demand for flatbed capacity, the national average spot flatbed rate made its first upswing in six weeks.

REEFER TRENDS

The number of reefer load posts was down 5% and truck posts were up 1%.

– Reefer load-to-truck ratio: 5.5 reefer loads per truck

– National average spot flatbed rate: $2.22/mile, down 1 cent

Among the top 72 reefer lanes last week, rates on 26 lanes were up, 44 lanes were lower, and two were neutral. Los Angeles and McAllen, Texas, both saw a rebound in reefer freight volumes but losses elsewhere help push spot rates lower for the fifth straight week. Volumes in this segment have fallen 3.1% in the last month.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $60 billion in freight payments.

Category: Featured, General Update, News