Spot Truckload Rates Hit New Highs in December; Vans Up 54 Cents YOY

DAT Reports national average truckload spot van and reefer rates increased for the seventh consecutive month

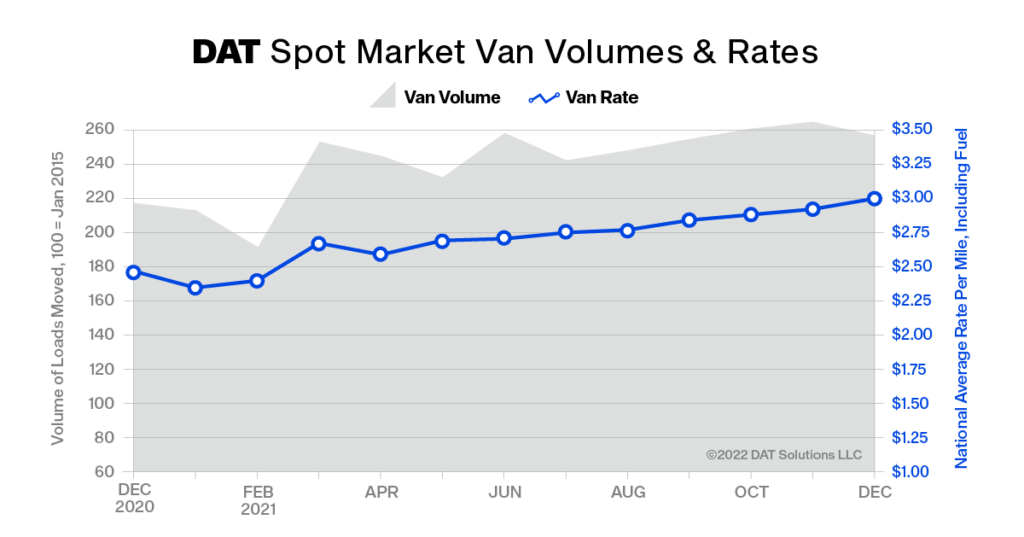

Van and refrigerated (“reefer”) truckload freight rates hit new highs in December, with national average prices up 21.9% and 29.5% respectively compared to the same period a year ago, said DAT Freight & Analytics, which operates the industry’s largest marketplace for spot truckload freight and the DAT iQ data analytics service.

National average truckload spot van and reefer rates increased for the seventh consecutive month and the average van rate reached $3 per mile for the first time. Spot truckload rates are negotiated on a per-load basis and paid to the carrier by a freight broker.

DAT’s Truckload Volume Index (TVI) was 236, a 3% decline compared to November when the Index set a record for the number of loads moved by motor carriers in a month. The TVI was up 18% year over year, reflecting strong truckload freight volumes as 2021 came to a close. The number of loads posted to the DAT One load board network increased 13.7% in December while truck posts fell 10.5%. Compared to December 2020, load posts increased 48.8% and truck posts were up 6.9%.

“While it’s not unusual to see a decline in the number of loads moved from November to December, spot-market volume was historically strong last month,” said Ken Adamo, Chief of Analytics at DAT. “Truckers experienced unparalleled demand during the holiday season.”

Van rate up 54 cents year over year

- At $3 a mile, the national average spot rate for van freight was up 7 cents compared to November and 54 cents higher than in December 2020.

- After increasing 17 cents month over month in November, the average spot reefer rate rose 2 cents to $3.47 a mile in December. The spot reefer rate has set a new high for six straight months and is 79 cents higher compared to the same period last year.

- The national average rate for flatbed loads on the spot market increased 2 cents to $3.08 per mile, a 59-cent gain year over year.

Flatbed load-to-truck ratio jumps 36%

- The national average van load-to-truck ratio was 6.5, up from 5.2 in November, meaning there were 6.5 available loads for every available van on the DAT network. The reefer load-to-truck ratio was 14.0, up from 11.9 in November.

- The flatbed ratio jumped to 51.1 from 37.5 the previous month, as unseasonably warm weather extended the construction season.

Contract rates hold steady

- The national average shipper-to-broker contract van rate was $2.94 per mile, up 1 cent month over month. The average contract reefer rate fell 1 cent to $3.11 a mile, while the average contract rate for flatbed freight was unchanged at $3.34 a mile.

- The national average diesel fuel surcharge was 40 cents a mile for van freight, down 1 cent from November when the surcharge was at a seven-year high.

Category: Connected Fleet News, Driver Stuff, Equipment, Featured, Fleet Tracking, General Update, Management, News