Spot truckload rates start 2022 at all-time highs

DAT Reports Spot truckload freight volume increased 25.7% during the week of Dec. 26-Jan. 1

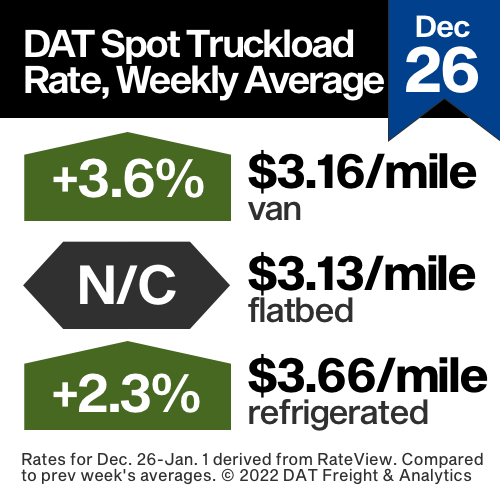

DAT Spot Truckload Market Summary, Dec. 26-Jan 1, 2022

DAT: Spot rates start 2022 at all-time highs

Spot truckload freight volume increased 25.7% during the week of Dec. 26-Jan. 1, said DAT Freight & Analytics, which operates the industry’s largest load board network and the DAT iQ data analytics service. The number of available trucks fell 26.0% compared to the previous week, which pushed spot rates higher.

Rates hit highs: Truckload spot van freight hit $3.16 per mile as a weekly average, up 12 cents compared to the previous week and an all-time high. The average spot reefer rate jumped 10 cents to $3.66 per mile last week, also a record high seven-day average, while the average flatbed rate was unchanged at $3.13 per mile. All rates include a fuel surcharge.

Demand increases: The national average van load-to-truck ratio increased from 6.0 to 10.4 last week, meaning there were 10.4 available van loads for every van posted to the DAT network. The reefer ratio was 34.3, up from 14.9 the previous week, and the flatbed ratio increased to 72.4 from 53.8. These ratios are considerably higher than the same period in 2020, when the van ratio was 7.0, the reefer ratio was 15.8, and the flatbed ratio was 52.1.

Post-holiday swing: It’s not unusual for demand for truckload capacity to swing significantly during the final week of December, when shippers are feeling urgency to move freight before the end of the year; more carriers take time off for the holidays; and traffic and weather can be unpredictable.

Data is derived from DAT RateView, the industry standard in truckload pricing. RateView is a database of $110 billion in actual spot and contract freight transactions across 68,000 lanes in North America. For more information, visit DAT.com.

Category: Connected Fleet News, Driver Stuff, Equipment, Featured, Fleet Tracking, General Update, Management, News