Spot truckload van, reefer rates crest at all-time highs

DAT Trendlines, week ending March 14

DAT: Spot truckload rates crest after several weeks of gains

Three weeks after winter storms upended supply chains across the country, truckload freight shipments settled into more normal patterns during the week ending March 14, said DAT Freight & Analytics, which operates the industry’s largest load board network.

The number of loads posted to the DAT network fell 11.4% and the number of trucks increased 9.2% compared to the previous week. The combination of easing capacity and more predictable travel conditions appears to have brought spot van, refrigerated and flatbed freight rates to a high plateau, cresting well above their averages for the month of February.

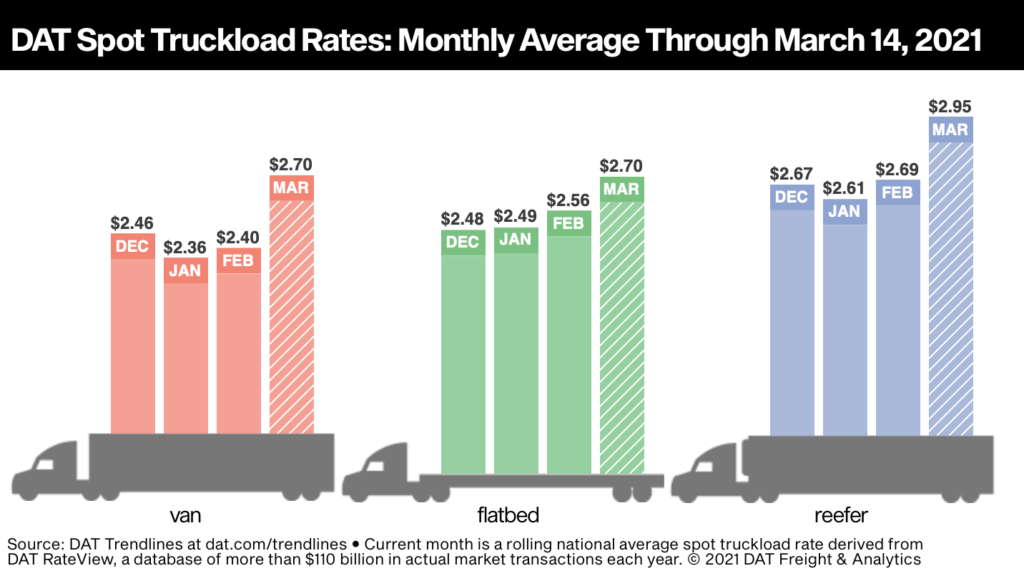

National Average Spot Rates, March

– Van: $2.70 per mile, 30 cents higher than the February average

– Flatbed: $2.70 per mile, 14 cents higher than February

– Refrigerated: $2.95 per mile, 26 cents higher than February

These are national average spot truckload rates for the month through March 14. They include a calculated fuel surcharge; diesel averaged $3.07 per gallon last week, up 3.3% compared to the previous week.

The seven-day average van and reefer line-haul rate, which excludes fuel, set all-time highs for the DAT network last week. The van line-haul rate averaged $2.40 per mile; the reefer rate was $2.61 per mile.

Trendlines

Flatbed demand stays elevated: Flatbed load post volumes have been on the rise for four weeks in a row and the national average flatbed load-to-truck ratio rose from 74.6 to 77.6 last week, more than 15 points above the February average.

The average spot rate increased on 50 of DAT’s top 78 flatbed lanes by volume compared to the previous week. Twenty-two lanes were neutral and the rate declined on six lanes. The country’s busiest lane for spot flatbed freight last week, Lakeland, Florida, to Miami, averaged $3.15 a mile and is up 11 cents over the past four weeks.

Flatbed market to watch: Baltimore is the number-one Roll-on/Roll-off (RoRo) port in the United States and handles most of the East Coast’s market share of RoRo cargo annually. Baltimore’s proximity to major farm and construction equipment manufacturers in the Midwest makes it key origin point for agriculture, farming and mining machinery. According to import data from PIERS, tonnage of RoRo equipment in February is up 301% year over year. Construction equipment represents 66% of total RoRo volume imports through the Port of Baltimore or the equivalent of 600 truckloads in February 2021, which is about 340 more truckloads compared to February 2020. So far, things are looking good for flatbed and specialized carriers.

Van volumes level off: While the number of loads moved was up 2% across DAT’s top 100 lanes for van freight, overall van load post volumes fell 23% week over week. With 11% more truck posts, the van load-to-truck ratio dropped from 7.8 to 5.4. The average rate improved on 44 of DAT’s top 100 lanes, was neutral on 27 lanes and was lower on 29 lanes.

Van markets to watch: Pricing held firm in key van markets despite declining outbound load volume, indicating that capacity is tight. In Memphis, volume was down 10% but tight capacity helped push the average van rate up 9 cents to $3.29 a mile compared to the previous week. In Atlanta, load volume declined 13% yet the average rate increased 5 cents to $2.74 a mile. And in Los Angeles, the average outbound rate increased 2 cents to $3.32 a mile despite 27% less volume.

Reefer rates cool: Spot rates in the reefer sector remain exceptionally high for this time of year. At $2.95 per mile, the national average spot reefer rate is 75 cents higher compared to the March average in 2020. Colder weather in the upper half of the U.S. this week should keep reefers in demand as shippers add “protect from freeze” to bills of lading to prevent temperature-sensitive dry freight from freezing.

Reefer load post volume dropped by 23% week over week. With 8% more truck posts last week along with fewer load posts, the reefer load-to-truck ratio slipped from 15.6 to 11.0. The number of loads moved on DAT’s top 72 reefer lanes by volume was virtually unchanged compared to the previous week. The average rate, however, was higher on 43 of those lanes, neutral on 12, and lower on 17 lanes. Again, tight capacity is providing a toehold for spot truckload rates.

Category: Driver Stuff, Featured, Fleet Tracking, General Update, News