Total Spot Rates Sink to Their Lowest Level Since July 2020

Spot Market Insights is provided weekly by Truckstop with analysis and commentary from FTR

Total Spot Rates Sink to Their Lowest Level Since July 2020

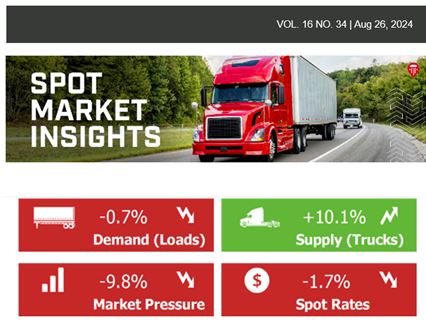

Data from Truckstop and FTR Transportation Intelligence for the week ended August 23 show the weakest broker-posted rates for the spot market since July 2020 due primarily to the ongoing decline in flatbed spot rates, which are now less than a penny higher than they were during late July 2020. Dry van spot rates are slightly stronger than flatbed relative to their mid-2020 levels. Although dry van rates in the latest week were higher than in nearly a dozen weeks in 2023 and 2024, they were only about 5 cents higher than in June 2020. Refrigerated rates ticked up by a minuscule amount in the latest week, but they recorded their largest year-over-year deficit since early March. The current week (week ending August 30) represents a critical benchmark for assessing the market, as spot rates for van equipment almost always see healthy gains during the week before Labor Day.

Total load volume was at its lowest level of the year except for the week that included the Fourth of July. Although load postings declined slightly in the latest week, truck postings rose sharply, especially for a week unaffected by holiday distortions. The result was a Market Demand Index of 48.9, which is the lowest level since the end of December.

Category: Driver Stuff, Equipment, Featured, General Update, News, Vehicles