Truckload volumes slipped in April; spot van, reefer rates

Truckload volumes typically decline from March to April, with freight movement in a seasonal lull

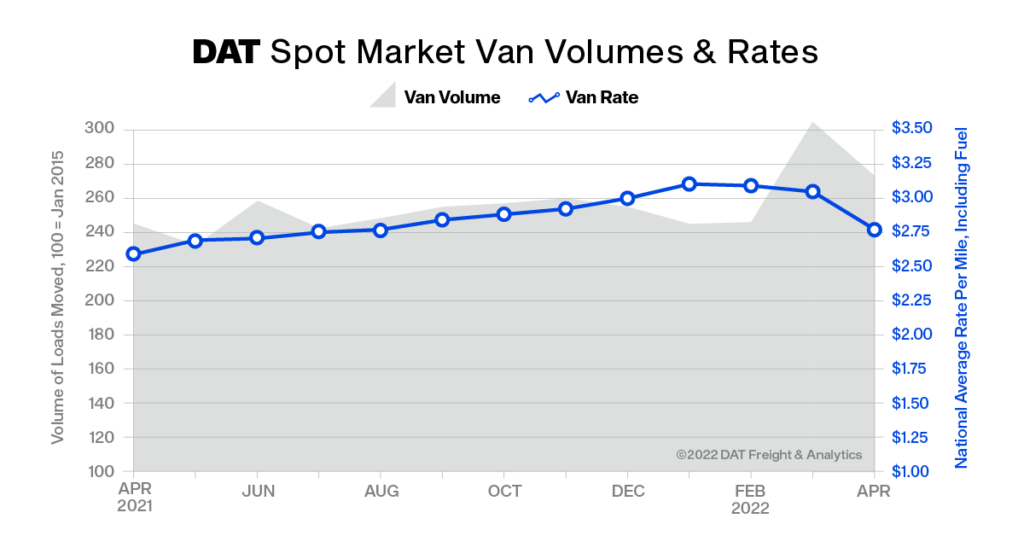

Truckload freight volumes retreated and spot-market rates dropped sharply in April, compounding pressure on small trucking companies and independent operators already strained by record fuel prices, said DAT Freight & Analytics, operators of the industry’s largest truckload freight marketplace and DAT iQ data analytics service.

DAT’s April Truckload Volume Index (TVI) for dry van freight was 273, 10% lower compared to March; the refrigerated TVI was 190, down 10%; and the flatbed TVI was 229, a 6% decrease.

Truckload volumes typically decline from March to April, with freight movement in a seasonal lull. Year over year, the April TVI was 12% higher for van freight, 10.5% higher for reefers and 15.1% higher for flatbed loads, indicating strong overall demand for truckload services.

The national average price to move van freight under contract remained at $3.26 per mile in April, extending the previous monthly high. The average contract reefer rate was $3.43 a mile, unchanged from March, while the flatbed rate rose 9 cents to $3.79 a mile.

Spot load-posting activity fell 27%

On the spot market, where terms to move loads are negotiated as one-time transactions between a freight broker and a carrier, the supply of trucks outpaced demand and drove rates substantially lower.

The national average van load-to-truck ratio dropped from 4.6 in March to 3.4, meaning there were 3.4 available loads for every van posted on the DAT One load board network. The reefer load-to-truck ratio was 6.3, down from 8.4, while the flatbed ratio fell from 89.8 to 64.5. Compared to March, there were 27% fewer loads posted in April and 2.8% fewer trucks.

Spot van rate fell 28 cents per mile

The national average van rate fell 28 cents to $2.77 per mile, the lowest monthly average since August 2021. The spot reefer rate was $3.13 per mile, down 32 cents, and the flatbed rate was unchanged at $3.40 per mile, a record high.

Spot rates incorporate a fuel surcharge. Removing fuel, the van rate averaged $2.13 a mile; the reefer rate was $2.43 a mile; and the flatbed rate was $2.63 a mile. The national average price of diesel fuel was $5.12 per gallon, up 2 cents compared to March and $1.99 higher year over year.

“Our April TVI data supports what we’ve been communicating for months: shippers are seeing increased routing guide compliance at the same time truckers on the spot market are contending with extreme volatility in lower rates and higher fuel costs,” said Ken Adamo, DAT’s Chief of Analytics. “We expect these conditions to continue. However, we have yet to see the glut of capacity and overall lack of freight that produced a prolonged down-cycle in late 2018 and 2019.”

Category: Connected Fleet News, Driver Stuff, Equipment, Featured, Fleet Tracking, General Update, News, Products, Vehicles