US Freight Cycle Near Bottom

ACT Research says though April will likely mark the bottom of the spot rate downcycle, elevated Class 8 build rates will limit the near-term upside

According to the latest release of the Freight Forecast, U.S. Rate and Volume OUTLOOK report, ACT Research says though April will likely mark the bottom of the spot rate downcycle, elevated Class 8 build rates will limit the near-term upside.

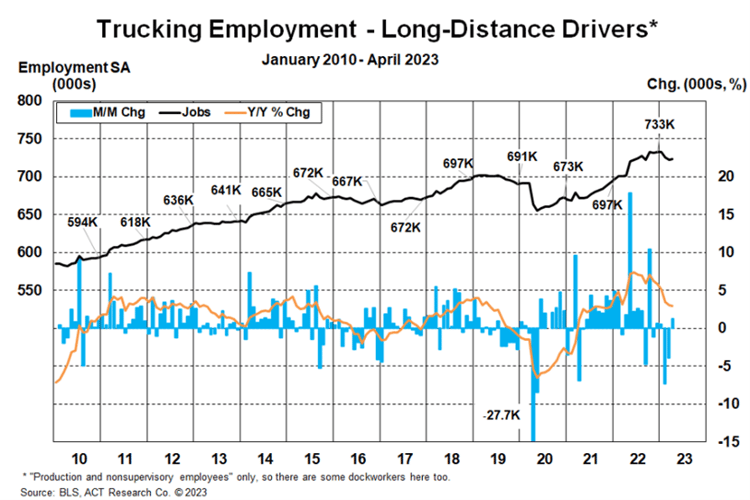

“Spot rates rose in May, but strong new equipment production will slow the ascent initially. Class 8 backlogs are sufficient for a while but are starting to dwindle as order activity has declined with industry profitability,” shared Tim Denoyer, ACT Research’s Vice President and Senior Analyst. “That spot rates have largely held onto the gains from Roadcheck suggests the freight market is close to the elusive balance, but the rebalancing so far has been mainly on the labor side.”

Regarding fleet capacity, Denoyer added, “Though equipment capacity is still growing, labor capacity is tightening as some fleets shrink and others exit. Aside from the pandemic capacity shock in April 2020, we are on track for a record contraction in labor capacity this year, which is key to the bottoming process.

.”

Denoyer concluded, “Though the near-term freight volume outlook remains muted, seasonal increases in freight later this year will meet tighter capacity, pushing the cycle forward.”

Category: Driver Stuff, Equipment, Featured, General Update, News