US Freight Market Bouncing Along the Cycle Bottom

ACT Research reports capacity rebalancing is well under way, albeit slower than expected, and demand is poised to gradually recover from the soft levels

According to the latest release of the Freight Forecast: U.S. Rate and Volume OUTLOOK report, driver capacity models suggest the record declines in freight rates should be pushing out more jobs, generating the kind of creative destruction needed to set up the next cycle, while tremors in the LTL market could press the industry rebalancing forward.

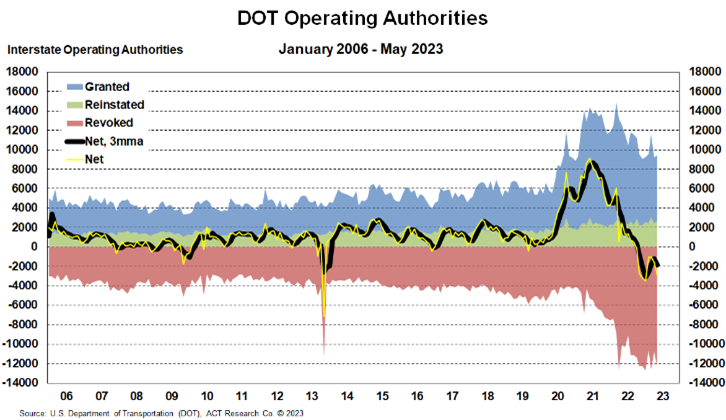

“While there may be capacity reduction in LTL soon, fleets are focused on retention despite record rate reductions, resulting in a gradual rebalancing,” shared Tim Denoyer, ACT Research’s Vice President and Senior Analyst. “The preliminary BLS data set, which we think gets closest to drivers, added 2.3k jobs in May, defying gravity for now. Some of this probably came from the owner-operator community, where net revocations of DOT operating authorities continue apace. We estimate another 12,400 total revocations of operating authority and 2,950 net revocations in May, bringing the total contraction in the industry since last October to over 15k fleets.”

Capacity rebalancing is well under way, albeit slower than expected, and demand is poised to gradually recover from the soft levels of the past five or six quarters, so the fundamentals for a recovery are in place.

“The spot market is continuing to rebalance with net revocations still at record rates. Even as the overall market is still on the loose side, the pendulum has started to swing,” Denoyer concluded. “The trajectory of spot rates has changed in the past couple of months, and we think demand fundamentals are likely to improve from here as we pass the worst of the destock. So, more freight market dynamics are in store down the road.”

Category: Equipment, Featured, General Update, Management, News, Vehicles