Will Electric Vehicle Companies Surpass Trillion-Dollar Tech Giants

FN Media Group Presents Oilprice.com Market Commentary

Hedge fund bulls say Tesla (TSLA) is on its way to a $2-trillion market cap after gaining 400% this year. It’s already worth 5X the combined value of giants Ford and GM, and it’s an industry disrupter that’s making millionaires out of anyone who ties-in with them. And the auto industry disruption tie-ins are many, varied… and potentially lucrative. Mentioned in today’s commentary includes: Tesla, Inc. (NASDAQ: TSLA), NIO Limited (NYSE: NIO), Blink Charging Co. (NASDAQ: BLNK), Fisker Inc. (NYSE: FSR), Exelon Corporation (NASDAQ: EXC).

From new EV startups and batteries or fuel cells, to ride-sharing with an ESG twist and car subscription companies that are challenging our ideas of ownership. The ideas are racking up, and the growth runway potentials are phenomenal.

EV startup NIO (NIO) has gained over 1500% this year. EV charging stock Blink (BLNK) has gained 1400% YTD. Now, mergers and consolidations are the name of this game as all the tie-ins fight for market share. EV startup Fisker (FSR) opted to go public, and acquired Spartan Energy (SPAQ).

Food delivery—another mobility tie-in—is in a state of all-out war for market share. Giant Uber is acquiring rival Postmates for $2.65 billion. Just Eat Takeaway is acquiring Grubhub for nearly $7 billion …And the innovative outlier hoping to steal the show is Canadian Facedrive (FD; FDVRF), the only ride-hailing and food delivery platform that has an ESG angle with carbon-offset operations.

The Biggest Change Yet Is Coming To Transportation

As a part of the clean energy transition, the world is racing to roll out the next era of transportation: electric vehicles. But there’s yet another disruption happening in the industry.

Not only will conventional gas-powered vehicles in time be on the chopping block…the entire concept of owning a car may be on the verge of extinction sooner than you think. And Facedrive is among the first movers in this surprising new market.

It scooped up Steer, a subscription-based electric vehicle provider in September in a deal that included a $2-million strategic investment by energy giant Exelon’s wholly-owned subsidiary, Exelorate Enterprises, LLC.

When you combine the $5 trillion global transportation industry with an energy industry whose renewables sector is quickly growing, you’ll see a trend that is in its infancy. But make no mistake about it – it will be a trend that upends the entire automotive sector. This is where Facedrive’s acquisition of Steer really comes into its own.

Steer is a new all-inclusive, monthly, risk-free car subscription service that is 100% electric, plug-in and hybrid. And it is predicting that transportation is ready for another round of evolution. The success of subscription based ‘leasing’ models is already well documented, and this simple concept could be at the core of the next major disruption in the auto industry.

We’ve already seen it with electric bikes and scooters. But this step could change everything. Imagine being able to have a clean, convenient, quality-controlled electric vehicle personally delivered to you whenever you needed it. Without the hassle of maintenance or insurance. And it’s affordable.

Better yet, you aren’t investing in something that immediately loses its value as soon as you drive it off the lot. It’s one answer to the last remaining hurdle of full-on adoption of EVs. And unlike leasing a car—there’s no mileage limit. And the growth runways are phenomenal when you consider that 70% of Steer members have never even driven an EV before. That means that these are new converts.

Anyone who couldn’t afford to ride an EV before, can now, with Steer. But it’s a diverse collection that allows users to drive pretty much any EV, hassle-free, including an Audi e-Tron or a Hyundai Kona, both new all-electric SUVs with ranges of over 250 miles.

Food: The $26B Shared Mobility Vertical

Facedrive (FD; FDVRF) was the first ride sharing company to see the “impact investing” writing on the wall. It saw where things would go wrong for Uber, which completely ignored sustainability.

It saw what would happen when studies showed that ride-hailing results in nearly 70% more pollution than whatever transportation it displaced. Then Facedrive launched an ESG coup: The were the first to offer customers an EV option, and then to plant trees to offset their carbon footprint. Then they applied that same “people and planet first” business model to a second vertical: Food delivery—the carbon-offset version.

Facedrive’s acquisition of Foodora from Deliver Hero positioned it near the top of Canada’s food delivery hierarchy overnight. And Foodora’s former owner Delivery Hero is the rare food delivery company not carrying around negative reputational baggage for bullying customers and restaurants at a time when they are struggling to make ends meet. They are international giants with services in 40 countries and a portfolio of over 500,000 restaurants. And Facedrive’s new acquisition has hit the ground running …

The new Facedrive Foods app was launched a few weeks ago, and already it’s processing 3,000 orders daily, with close to 4,000 restaurant partners and over 220,000 active users.

This Is Where Big Names Are Gathering

Exelon’s (EXC) market cap is ~$41 billion and it’s not the only huge market-cap company whose radar is pinging Facedrive: There’s also a tie-in to eCommerce King Amazon. Both global e-commerce giant Amazon and Canadian Tier-1 telecoms giant Telus jumped in on Facedrive’s corporate partnership program. And that news flew right under the radar because it wasn’t officially announced and was revealed only when Facedrive released its Q1 earnings report.

That means both giants will be Corporate partners of Facedrive meaning that their employees will receive preferred rates on Facedrive products and services. And they have.

In October, Air Canada became the next big name to jump on the Facedrive bandwagon. With the global tourism industry facing $1 trillion in losses and on track to shed 100 million jobs before the year is out, Air Canada has signed a deal with Facedrive (FD; FDVRF) to launch a pilot project for its employees using TraceSCAN, Facedrive’s proprietary COVID contact-tracing technology and wearables.

So, watch the news flow on that one, too as talks progress with more big airlines. The name of this game is ultimate impact. Facedrive is chasing Big Money earmarked for ESG-focused plays at a time when the world has just hit the trillion-dollar mark in ESG fund investments.

Big capital has tons of money to put into low-risk impact investing. But they can’t find enough places to park it.

Facedrive (FD; FDVRF) has been ahead of the curve from day one. At this point, there’s no stopping the march of EVs, and this is the company that brings it all together in a comprehensive ESG ecosystem. And with so many verticals, the news flow is hard to keep up with.

The Electric Vehicle Revolution Is Kicking Into High Gear

Tesla (TSLA) is now the most valuable car maker “of all time”. Tesla is worth almost $495 billion, while the top three American automakers–GM, Ford and Chrysler–are worth around $129 billion combined. This year alone, Tesla has risen by 460%, and is showing no signs of slowing. Especially now that the company is set to be included in the S&P 500.

There’s a reason Tesla has performed so well this year. Investors love Elon Musk’s vision. As one of the world’s most innovative car manufacturers, it has single-handedly made electric vehicles cool. Its slick design is beloved across the world. In fact, it’s almost impossible to NOT see a Tesla in cities like Hong Kong or San Francisco.

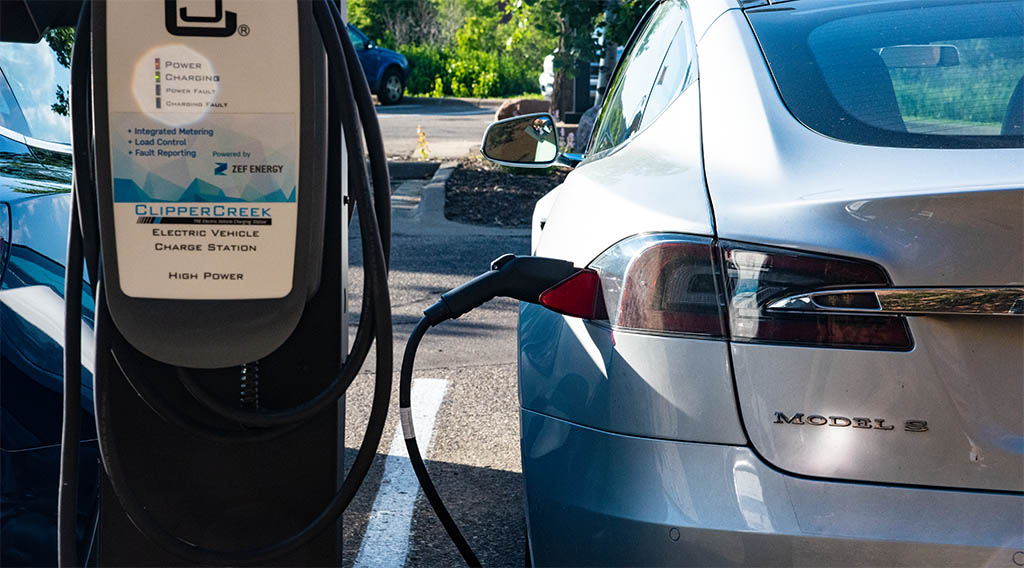

Tesla’s success has also fueled a boom in other EV-related companies. Blink (BLNK), for example, an electric vehicle charging company, has risen by over 1400% since the beginning of the year, and the sky is the limit for this up-and-comer. A wave of new deals, including a collaboration with EnerSys and another with Envoy Technologies to deploy electric vehicles and charging stations adds further support. .

Michael D. Farkas, Founder, CEO and Executive Chairman of Blink noted, “This is an exciting collaboration with EnerSys because it combines the industry-leading technologies of our two companies to provide user-friendly, high powered, next-generation charging alternatives. We are continuously innovating our product offerings to provide more efficient and convenient charging options to the growing community of EV drivers.”

NIO Limited (NIO) is another electric vehicle giant having an incredible year. Though many analysts and even the most experienced traders were ready to leave it for dead just a year ago, the Chinese Tesla rival shocked markets, blowing away Wall Street estimates, and most importantly, keeping its balance sheet in line. And thanks to its efforts, the company has seen its share price soar from $3.24 at the start of 2020 to a high of $54.39 earlier this week, representing a stunning 1578% return for investors who have held on strong. And it’s just getting started.

Nio has made all the right moves over the past year to win over investors and turn heads on the streets and in the marketplace. On November 18th, NIO revealed a pair of sedans that even the biggest Tesla die-hard would struggle to pass up. The vehicles, meant to compete with Tesla’s Model 3, could be just what the company needs to pull back control of its local market from Elon Musk’s electric vehicle giant.

Compared to Tesla or NIO, Fisker (FSR) is a relative newcomer to the scene, having only IPO’d in October. While it hasn’t seen quite the attention other electric vehicle stocks have seen in recent weeks, it is an important company to watch. It’s unique in the industry because it boasts the most sustainable vehicle on the road: It’s not just electric… it’s also is made with some recycled materials. That’s a huge plus considering how much investors are focusing on sustainability these days.

Though Fisker has underperformed on the market compared to NIO, Tesla, Xpeng or Li, it’s still trading on massive volume and in just one month, has already climbed by 50% since its IPO. Clearly, investors are still waiting to see how the company will hold up, especially following the Nikola disaster.

Though not strictly an automotive company, Exelon (EXC) has its fingers in a lot of pies. As one of the top electricity providers in the United States, Exelon is a specialist in the industry. And it’s making big bets on sustainability.

From nuclear to hydro and solar, Exelon Generation is at the cutting-edge of renewable energy. Thanks to its large footprint across the energy industry and forward-thinking attitude, it’s performed consistently on the stock market, climbing by 49% over the past 5 years. And though that might not seem like a massive return for many growth investors, it’s provided strong dividends every step of the way.

By. Terry Goddard

Category: Electric Vehicles, Featured, Fuel & Oil, General Update, Green, News, Vehicles