ComFreight Launches Mobile App For Trucking Payments

ComFreight, a Long Beach, CA-based company that has been building an advanced load board and freight marketplace, released its first mobile app for invoice payment advances and for booking loads.

The new mobile app is aimed at helping smaller carriers and owner-operators with finding loads and funding payment advances.

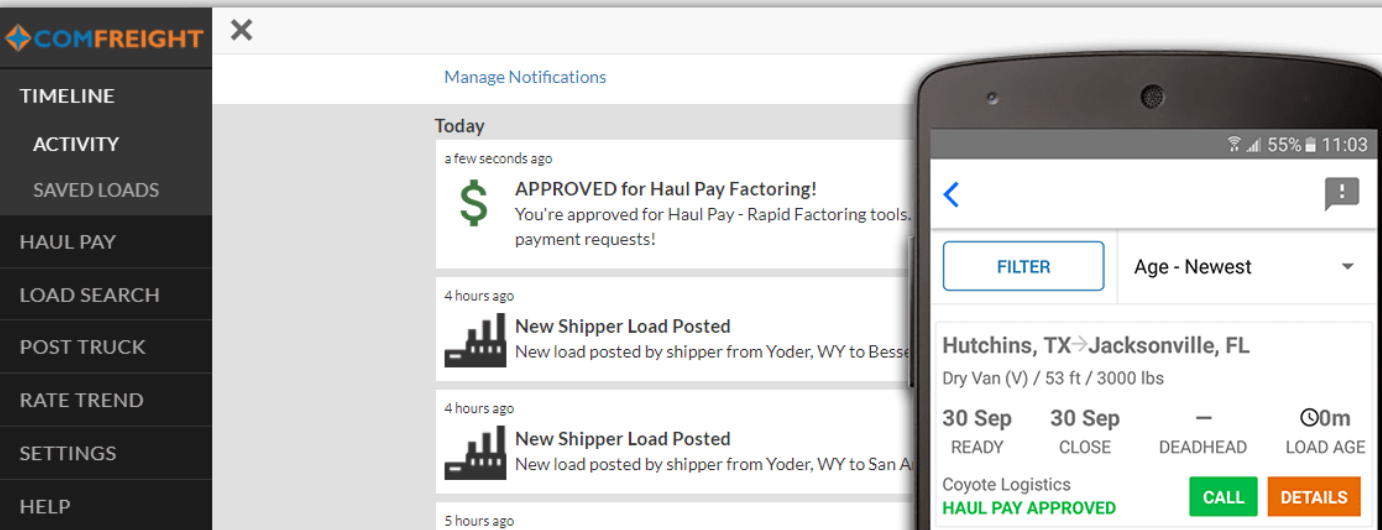

Carriers use the free mobile app to find and book loads and then confirm their deliveries to receive instant payments. Users just upload or take a photo of their signed bill of lading and rate confirmation to confirm a payment request.

The app also updates the user on their payment and customer credit statuses. This means a carrier is updated in real time via push notifications once their funds are on the way to their bank account to be deposited.

If a carrier’s customer has a change in credit approval or a credit warning is set, the user is also instantly notified via push notifications in the mobile app.

Users are also able to check new customer credit, track payment and income history and receive new credit decisions on new shippers, not already in ComFreight’s marketplace, in less than 24 hours.

Loads that are preapproved for are labelled with an emblem throughout the app experience to make it easy to see which shipper or broker loads are prequalified for instant payments upon delivery.

“We’ve integrated our freight marketplace for loads with the fastest and lowest cost non-recourse factoring alternative available in the industry today,” said Steve Kochan, ComFreight Co-Founder and CEO.

Because ComFreight is not a broker it’s able to work with and qualify loads on credit terms from more potential sources for its marketplace than competitors.

The marketplace now sees around 100,000+ daily available loads posted by shippers and brokers in the US and Canada. More than half of these loads are preapproved for instant payments upon delivery for users who have joined the Haul Pay program.

ComFreight is also testing a new digital payments API which will support even faster funding capabilities for users . “Having a growing marketplace of shippers, carriers and brokers enable us to pilot new concepts for the industry in our own sandbox and get immediate feedback on what really works,” said Kochan.

Category: General Update, News