Class 8 Tractor Demand Above Replacement Level in January

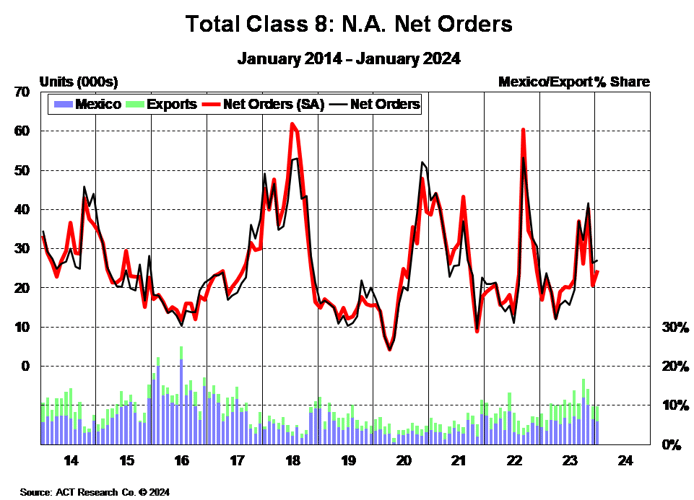

ACT Research reports Class 8 net orders, at 27,125 units, were up 45% y/y

Final January Class 8 net orders, at 27,125 units, were up 45% y/y. Total Classes 5-7 orders were up 14% y/y at 19,954 units, as published in ACT Research’s latest State of the Industry: NA Classes 5-8 report.

“US Class 8 tractor orders surprised to an above-replacement level of 16,765 units, up 44% y/y,” according to Kenny Vieth, ACT’s President and Senior Analyst. “Seasonality is one component, but given the state of for-hire truckload rates, we continue to suspect private fleets as the primary driver behind US tractor demand. As well, the LTL segment remains a bright spot relative to TL and is likely also contributing. The US economy’s current strength doesn’t hurt either.”

Regarding Classes 5-7, he added, “MD build totaled 20,931 units, up 21% y/y. Inventories remain highly elevated, as MD bodybuilder labor challenges persist, totaling 85,330 units

nominally, up 31% y/y. Classes 5-7 retail sales remained strong at 19,950 units.”

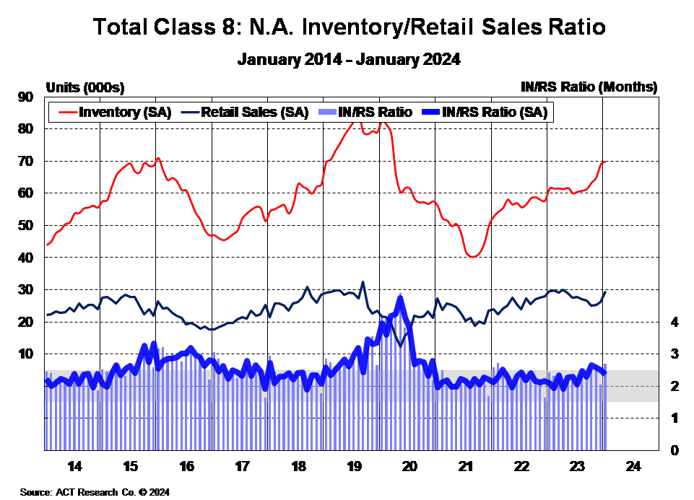

“Class 8 build decreased 7.3% y/y to 26,926 units in January,” Vieth concluded. “Class 8 inventories rose 1,909 units m/m to 66,277 in January, up 14.3% y/y. Following December’s dash to get equipment finished ahead of regulations starting at the beginning of 2024, Class 8 retail sales totaled 24.5k units in January, up 2.9% y/y. Amid the weakest period of the year for retail sales, and with still strong production, we continue to see risk in the potential for rapid inventory escalation in early 2024.”

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Vehicles