DAT Freight Trends on the Spot Market: March 23-29, 2020

Spot truckload rates peaked on March 22 and then tumbled

Rates Crest as Truckers Ride an Up-and-Down Market

Spot truckload rates peaked on March 22 and then tumbled during the week ending March 29 as supply chains respond to the COVID-19 outbreak.

The national average rates for spot van and refrigerated have settled down at levels that are more in line with seasonal expectations, said DAT Solutions, which operates the industry’s largest load board network.

However, given how uncertain business conditions are right now, it’s unclear whether the trend will turn into a sharp downward rate correction, a holding pattern, or a return to the upward trajectory of recent weeks.

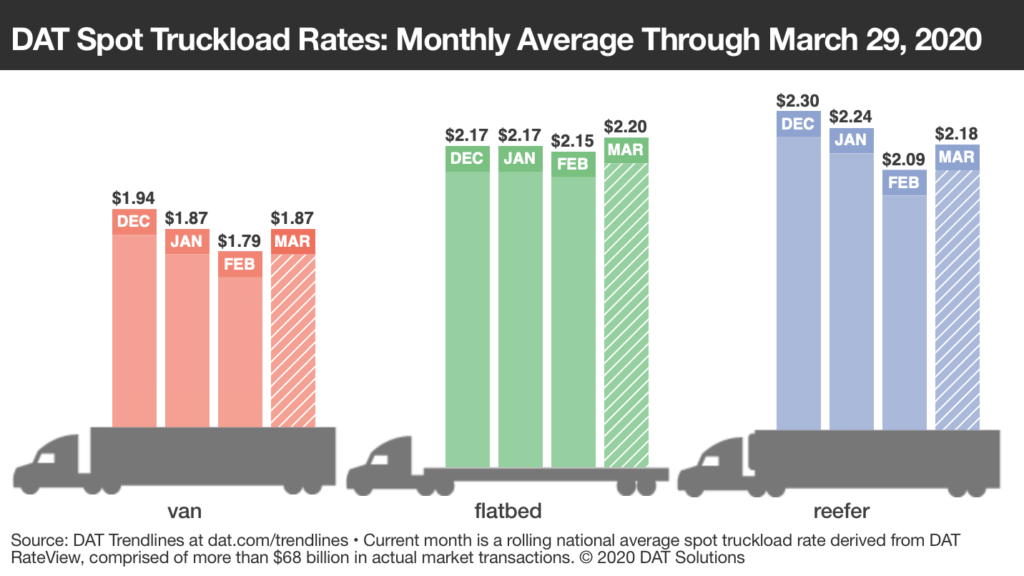

National Average Rates, March (through March 29)

– Van: $1.87 per mile, up 2 cents from last week and 8 cents higher than the February average

– Reefer: $2.19 per mile, up 3 cents from last week, and up 10 cents compared to February

– Flatbed: $2.19 per mile, down a penny from last week, and up 4 cents compared to February

Van Trends

Last week, spot van rates were higher on 71 of the top 100 high-volume van lanes on DAT load boards. The national average van line-haul rate increased more than 11% from March 1 ($1.51 per mile) to March 22 ($1.68), and declined during the week to $1.57 (line-haul rates do not compensate for fuel costs). All told, the increase in the line-haul rate in March is a more modest 4%.

Lower rates are the result of less demand, as slowdowns and business closures have reduced the overall need for trucks. The national average van load-to-truck ratio was 2.8 last week, down from 3.5 the previous week. This is the first week-over-week decline after eight weeks of gains.

At 2.8, the van load-to-truck ratio is now at February levels. That’s actually an improvement compared to the same period in 2019. Lower van ratios in the coming weeks would be consistent with seasonal norms, while staying ahead of 2019 trends.

Reefer Trends

The national average reefer load-to-truck ratio fell to 4.9 from 7.8 the previous week, a sign that rates will soon soften. Only one of the top 72 reefer lanes paid less last week than it did the week before.

For now, spot reefer rates are still trending up in California, Texas, and parts of the Southeast where produce imports are on the move. Dallas to Columbus, Ohio, averaged $1.98 per mile, up 15 cents; Stockton, Calif., to Portland, Ore., paid $2.93, up 30 cents; and Miami to Baltimore gained 20 cents to $2.04.

Domestic produce volumes and timing can be unpredictable, which is why it’s a large component of the spot market. Contract carriers tend to prefer hauling fresh foods and beverages that are delivered on regular schedules: meat, eggs, dairy, frozen food. The arrival of produce season across many regions of the country will add to the demand for van, reefer, and flatbed equipment in agricultural markets.

This summary’s month-to-date national average rates were generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $68 billion in freight payments. DAT load boards average 1.2 million load posts searched per business day.

Category: Featured, General Update, News