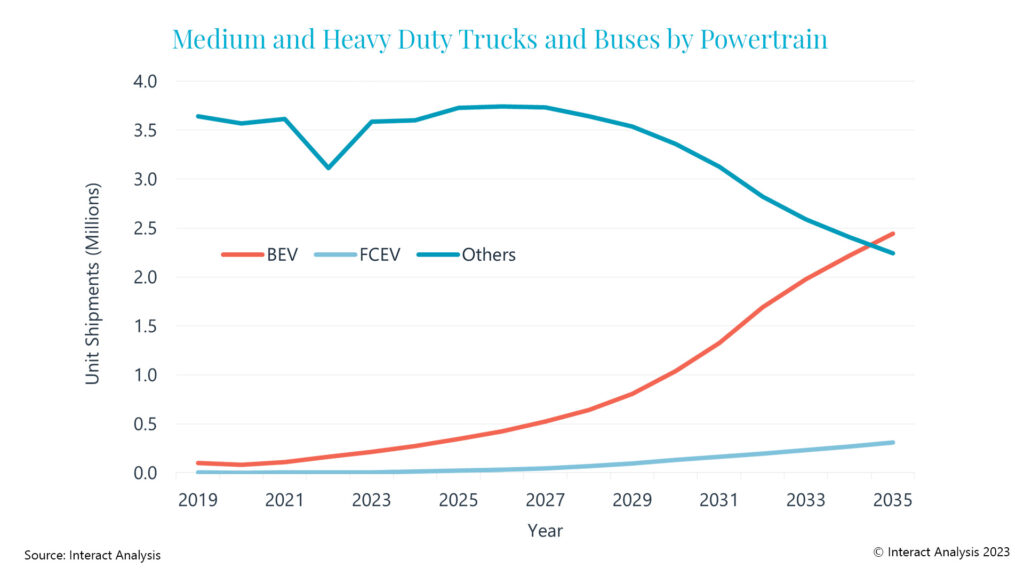

Half of all medium and heavy-duty trucks and buses sold in 2035 to be electric

According to the latest research by global market intelligence firm, Interact Analysis, battery electric vehicle powertrains will become the favored powertrain for commercial vehicles by 2035

Battery electric is expected to replace ICE as the leading powertrain type for commercial vehicles by 2035, according to global market intelligence firm, Interact Analysis. It is expected that almost 2.5 million battery electric commercial vehicles will be sold in 2035 compared with fewer than 500,000 forecast to be sold in 2025. Currently, the battery pack accounts for more than half (55%) of battery electric vehicle powertrain revenues, with price erosion forecast over the coming years, driving growth and increasing the appeal of battery electric commercial vehicles.

Taking a look at the commercial vehicle market as a whole, fuel cell vehicles are expected to represent a small share because they are best suited to vehicles that travel long distances. Hybrid vehicles will also comprise a small share of the market due to a lack of focus on the technology from manufacturers and a shortage of regulatory support, which provides no compelling argument for adoption. Battery electric appears to be the clear winner for commercial vehicle powertrains. This is largely due to low operating costs (which make up for the high upfront cost), alongside regulations and subsidies which appeal to customers.

Battery pack dominates powertrain revenues

For battery electric vehicles, the battery pack accounts for most of the powertrain revenue – around 55% in fact. This component has the greatest impact on the overall cost of a commercial vehicle, while motors, inverters and the transmission have little influence on the overall vehicle price. In contrast, for fuel cell vehicles, the fuel cell system accounts for a much higher proportion of the total cost, while the transmission accounts for a higher proportion of the overall cost of hybrid vehicles.

The use of e-axles is a growing trend but one that is currently an expensive alternative to a separate motor, transmission and axle. As a relatively immature technology, the cost of an e-axle is much higher than traditional systems, but Interact Analysis expects this to change over time as volumes increase. One of the key advantages that e-axles offer is space saving, making it possible to add battery capacity and range to the vehicle, or have a smaller vehicle with the same battery capacity, reducing production costs. Depending on the customer’s viewpoint, e-axles may pay for themselves through the advantages they offer, despite having a higher initial upfront cost.

Jamie Fox, Principal Analyst at Interact Analysis, comments, “Currently, the upfront cost of a battery electric vehicle is high, and this is mainly due to the cost of a full electric powertrain. For a heavy-duty battery electric truck, the complete battery electric powertrain can cost as much as $100,000, but this can be as low as $2,000-$3,000 for a mild hybrid light duty truck. Despite this, we expect to see price erosion over time due to production innovation and economies of scale.”

Report focuses on pricing and architecture of powertrain components in on-road commercial vehicles (trucks & buses). Previously split into two reports for Asia Pacific and EMEA/Americas, this data is now combined into one report.

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Electric Vehicles, Engines & Drivetrains, Equipment, Featured, Fleet Diagnostics & Software, Fuel & Oil, General Update, Green, News, Products, Tech Talk, Vehicles