Longer Vehicle Life to Fuel Growth in Engine Control Unit Industry

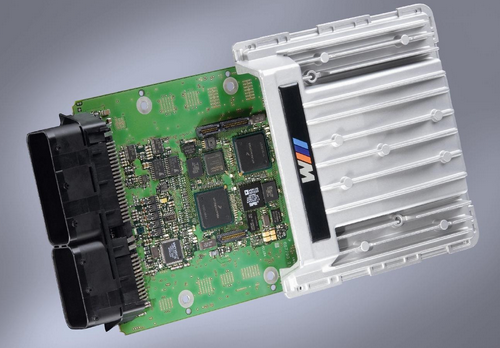

As the average vehicle life of operational vehicles in North America rises, a new study reports that the aftermarket for engine control units (ECUs) is anticipated to grow vigorously.

As the average vehicle life of operational vehicles in North America rises, a new study reports that the aftermarket for engine control units (ECUs) is anticipated to grow vigorously.

Specifically, a new analysis from Frost & Sullivan, “Opportunity Analysis of Engine Control Units (ECUs) in the North American Automotive Aftermarket,” finds that the market earned revenue of $580.1 million in 2012 and estimates this to reach $721.3 million in 2019.

Further, re-manufactured ECUs, in particular, will find more takers due to the price difference between new and remanufactured units. In the long-term, the emphasis on fuel-system efficiency and electronic content in modern automobiles will ensure stable market growth.

The study states that with people keeping their vehicles longer, the increasing number of aging vehicles generates replacement opportunities for the ECU aftermarket in North America. Moreover, escalating raw material prices and currency exchange fluctuations boost prices for new and re-manufactured engine control units and spur market revenue.

“The need to comply with stricter emission and fuel economy standards makes ECUs complex,” said Frost & Sullivan Automotive and Transportation Research Manager Stephen Spivey. “As sophisticated products enter the aftermarket and more foreign nameplate vehicles are serviced, the prices of ECUs will go up, thereby adding to manufacturers’ margins.”

Manufacturer-level revenue will increase by 3.2 percent annually over the 2012 to 2019 period, but restraints to growth remain. On the one hand rapid technological advances improve ECU quality, better longevity means that replacement rates are declining. At the same time, some consumers ignore the symptoms of a faulty ECU due to the associated high replacement costs, thereby slowing unit sales. The availability of cheap, low-quality Asian imports further curbs market development in the region.

Independent suppliers and repairers will lose their market share to auto dealerships in the original equipment service (OES) channel due to their lack of training, especially in terms of ECU failure diagnosis. In fact, the OES channel is best positioned to widen its consumer base as a result of excellent core management practices and a technological advantage over the independent aftermarket.

About Frost & Sullivan

Frost & Sullivan, the Growth Partnership Company, works in collaboration with clients to leverage visionary innovation that addresses the global challenges and related growth opportunities that will make or break today’s market participants. With more than 40 global offices, Frost & Sullivan has for more than 50 years been developing growth strategies for the global 1000, emerging businesses, the public sector and the investment community. More information at: http://www.automotive.frost.com.

Category: Engines & Drivetrains, Equipment, General Update