Low Trailer Orders and High Cancellations in January

January net orders, at 13,700 units, were nearly 43% lower y/y, and 10.7k units below December

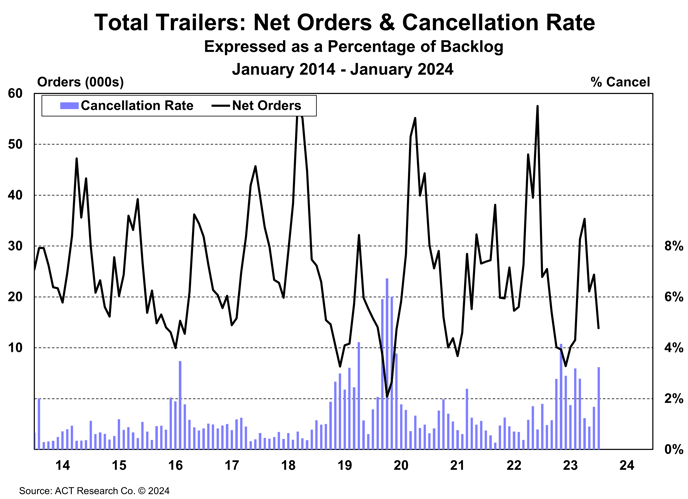

Weak freight rates continue to reduce carriers’ willingness to invest in equipment, resulting in low trailer orders and high cancellations in January, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

January net orders, at 13,700 units, were nearly 43% lower y/y, and 10.7k units below December. Total cancellations took a turn for the worse in January, jumping to 3.2% of the backlog from December’s elevated 1.7% rate.

“Seasonally adjusted, January’s orders fell to 12,400 units from December’s 15,400 SA rate. On that basis, orders decreased 28% m/m,” said Jennifer McNealy, Director–CV Market Research & Publications at ACT Research. “On a seasonally adjusted basis, dry van orders contracted 55% y/y, with reefers down 37%, and flats 34% lower compared to January 2023.”

She added, “Digging down into cancellations, several markets led the way, including dry vans at 4.2% of backlog and lowbeds at 1.5%. Clearly, with markets swimming in capacity, no one needs a higher trailer-to-tractor ratio. Additionally, both tank categories reported high cancels this month, with liquid at 3.7% and bulk at 10.2%. We continue to believe recent oil price weakness may bear most of the culpability there.”

McNealy concluded, “Healthy economic performance is increasingly favoring freight, but we are roughly balanced between the tail of an 18-month freight recession and the beginning of the next freight cycle, meaning limited capex available even with some dealers still challenged with more inventory than customers.”

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Vehicles