March Class 8 Net Orders May Finally Indicate Slowing Capacity Additions

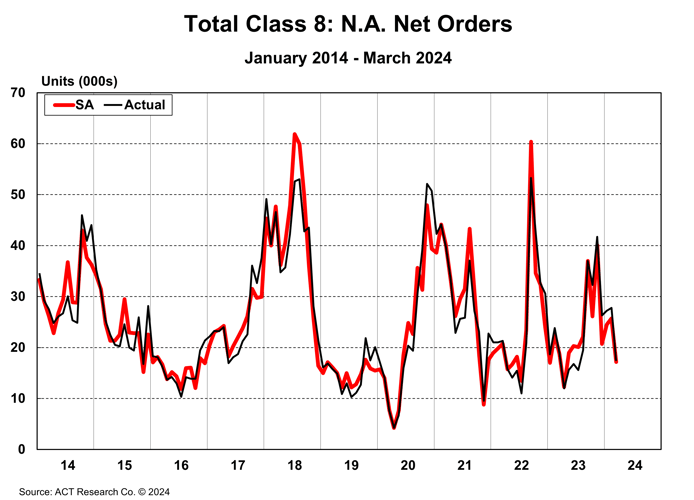

ACT Research reports final March Class 8 net orders totaled 17,410 units (17.2k seasonally adjusted), down 8.4% y/y

Final March Class 8 net orders totaled 17,410 units (17.2k seasonally adjusted), down 8.4% y/y. Total Classes 5-7 orders rose 23% y/y to 25,359 units (23.4k seasonally adjusted), as published in ACT Research’s latest State of the Industry: NA Classes 5-8 report.

“March orders may finally indicate a slowdown in capacity additions, a requisite for the freight market to turn, after a year of growth that defied typical fundamentals. Though we note, Q2 and Q3 are the weakest points in the calendar for orders, so the call is not prescient” according to Kenny Vieth, ACT’s President and Senior Analyst. “US tractor orders totaled 10,400 units, down 1.3% y/y. In the vocational market, total NA Class 8 truck orders fell 2.0% y/y to 5,300 units.”

“March orders may finally indicate a slowdown in capacity additions, a requisite for the freight market to turn, after a year of growth that defied typical fundamentals. Though we note, Q2 and Q3 are the weakest points in the calendar for orders, so the call is not prescient” according to Kenny Vieth, ACT’s President and Senior Analyst. “US tractor orders totaled 10,400 units, down 1.3% y/y. In the vocational market, total NA Class 8 truck orders fell 2.0% y/y to 5,300 units.”

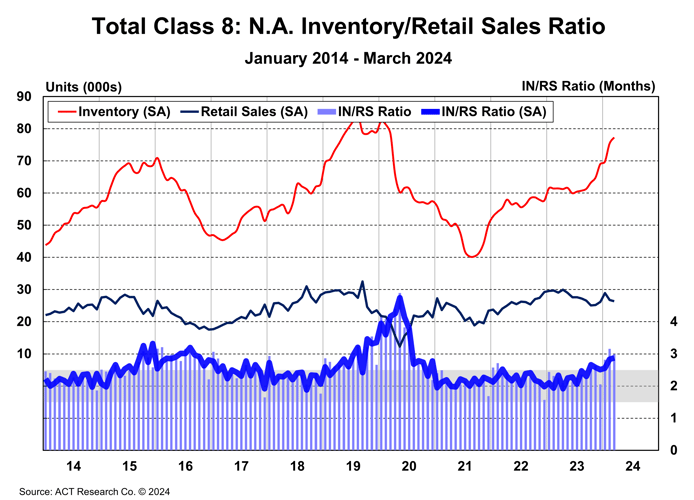

“Between strong production and softening US tractor sales the past six months, Class 8 inventories have risen substantively. Since last September, Class 8 inventories have risen nearly  15,000 units, hitting another four-year high in March,” Vieth continued. “Class 8 build totaled 29,854 units in March, down 5.0% y/y, but due to Easter, had three less production days this year. Total Class 8 retail sales were 25,942 units, down 13% y/y.”

15,000 units, hitting another four-year high in March,” Vieth continued. “Class 8 build totaled 29,854 units in March, down 5.0% y/y, but due to Easter, had three less production days this year. Total Class 8 retail sales were 25,942 units, down 13% y/y.”

Regarding Classes 5-7, he concluded, “Classes 5-7 inventories remained highly elevated in March, as medium-duty bodybuilder labor and supply-chain challenges persist. Inventory totaled 89,360 units on a nominal basis, up 22% y/y. Retail sales remained healthy at 20,320 units.”

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Vehicles