Market Forces Changing Across Truck Industries as Year End Approaches

Used semitrailer inventory levels increased considerably in November while auction and asking values continued to soften

The latest market reports from Sandhills Global reveal mixed signals across Sandhills marketplaces. Used heavy-duty truck and semitrailer markets, for example, are still accruing inventory, continuing a recovery trend that began in Q2 2022 after a period of historic inventory lows. As inventory grows, used heavy-duty truck and trailer values are softening further, showing both auction and asking value decreases, although these values are still higher than they were a year ago. The used construction equipment marketplace, meanwhile, is stabilizing, with month-to-month value increases slowing down. By contrast, used agricultural equipment values are staying strong, continuing a months-long trend of M/M value increases.

The current mix of trend lines is creating a somewhat complex landscape for equipment owners as they map out year-end acquisition and disposal strategies. “We’re still hearing equipment owners actively talking about market conditions and how they apply to liquidating equipment,” says AuctionTime Manager Mitch Helman. “Owners are making hard decisions about whether to liquidate now or wait until next year. Many are deciding that now’s the time. The way December auctions are currently shaping up, we’ll exceed all previous records for end-of-year sales.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The new heavy-duty truck and semi-trailer market reports examine a regional breakdown of inventory and values, as well as auction value trends across model age years.

U.S. Used Heavy-Duty Trucks

- The Sandhills EVI indicates that used heavy-duty truck inventory, which includes sleeper and day cab models, shot up in November, driving auction values lower. Used truck inventory levels increased 8.3% from October to November, and were up 68.3% year over year in November.

- Auction values continued a downward trend that began in April 2022, decreasing 0.8% M/M and 2.2% YOY in November. The last time YOY auction values were down for used heavy-duty trucks was in September 2020.

- Asking values decreased 0.59% M/M, continuing a trend of several months’ worth of decreases. Still, asking values were up 11.58% YOY.

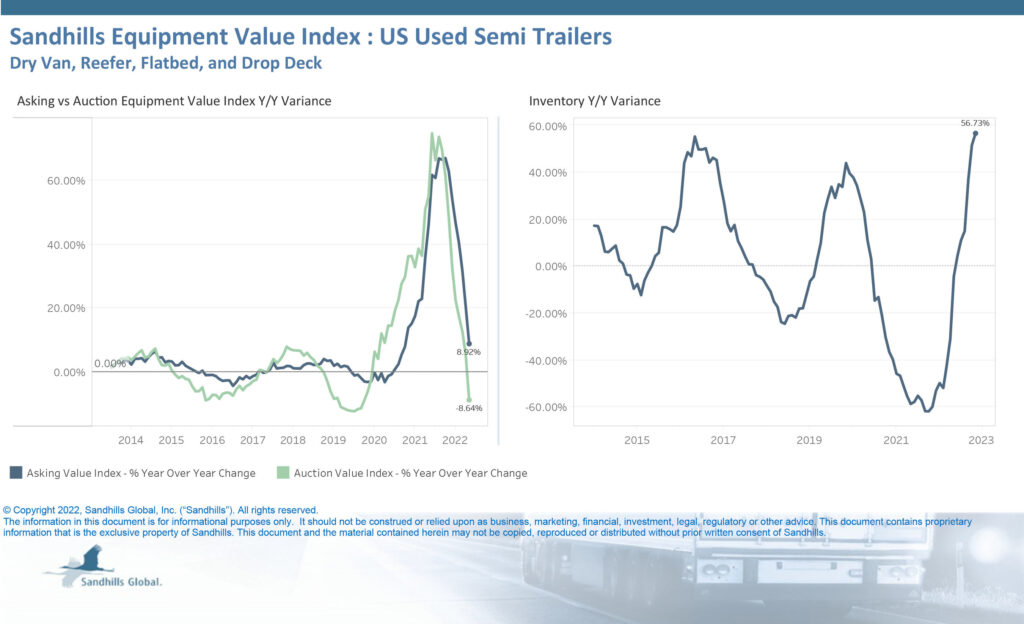

U.S. Used Semitrailers

- Used semitrailer inventory levels increased considerably in November while auction and asking values continued to soften. Inventory levels were up 6.09% M/M in November and currently show an upward trend. Levels were also up over last year, posting a 56.7% YOY increase.

- Continuing months of decreases, auction values fell 6.9% M/M in November and were down 8.64% YOY.

- Asking values also continued a months-long downward trend, decreasing 0.9% M/M. However, asking values were up 8.92% YOY.

U.S. Used Medium-Duty Trucks

- Inventory levels in this category, which includes used box trucks, flatbed trucks, and cab and chassis trucks, were up 5.59% M/M in November and are currently tracking up. Levels increased 79.5% YOY.

- For the second month in a row, auction values for used medium-duty trucks are lower than last year’s values, decreasing 2.69% YOY. Auction values increased 2.1% M/M and are currently showing a sideways trend.

- Asking values held steady M/M and were up 8.5% YOY.

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Equipment, Featured, General Update, Management, News, Products, Vehicles