New-Vehicle Prices Up Nearly 3% Year-Over-Year in March 2020, Despite COVID-19 Impact on the Economy

Prices Supported by Finance and Payment Deferral Incentives from Automakers and Captive Finance Companies

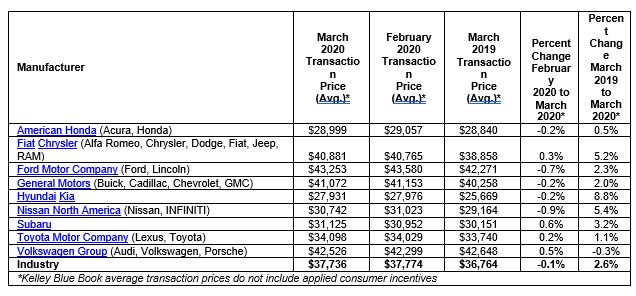

The valuation analysts at Kelley Blue Book reported the estimated average transaction price for a light vehicle in the United States was $37,736 in March 2020. New-vehicle prices increased $972 (up 2.6%) from March 2019, while dropped $38 (down 0.1%) from last month.

“While the automotive industry and broader U.S. economy were brought to a near halt in March, average transaction prices remained stable from February and increased from this time last year, showing strength in line with the first two months of the year,” said Tim Fleming, analyst for Kelley Blue Book. “Prices were supported by the abundance of incentives quickly enacted by manufacturers and their captive finance companies, including 0% financing for 84 months and payment deferrals of up to 180 days.”

With most of the country encouraged to stay at home for at least another month and unemployment skyrocketing as a result, the impact of this year’s auto sales will be severe. However, production is also at a standstill, as North American factories have been shut down for weeks. This coincidental drop in demand and lack of new supply is extraordinary. For March, new-vehicle prices remain solid, but there are still many unknowns about April and what the state of the economy will be for the remainder of the year.

Hyundai and Kia are still seeing the biggest gains for the major manufacturers as Hyundai rose 13% and Kia was up 5%. The redesigned Sonata helped Hyundai the most as it climbed 13% and second place in the mid-size car segment behind the Subaru Legacy. In March 2019, the Sonata had the lowest ATP in the segment. In addition, the Palisade continues to perform well, making up more than 10% of Hyundai sales with transaction prices above $40,000. At Kia, the Telluride rose 7% year-over-year, while the redesigned Soul was up 4%.

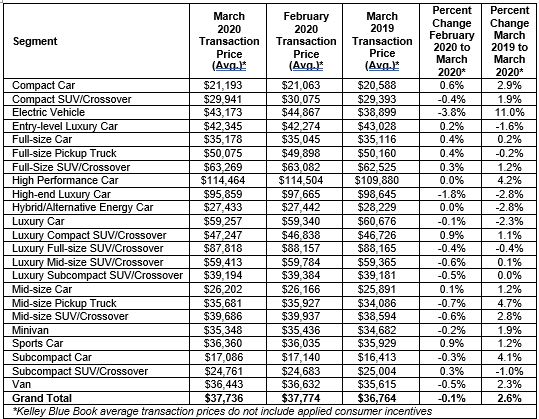

At the segment level, cars continue to suffer – in addition to falling sales and market share, average transaction prices were roughly flat in March and down year-to-date. In a month where oil prices dropped to about $20 per barrel and gas prices to $2 per gallon nationally, no segment was hurt worse than hybrid cars, which fell nearly 3%. Electric vehicles did see prices rise, but that was tied more to the Audi e-tron, which was not available at this time last year. Prices of full-size SUVs, a segment that usually performs well when gas prices are low, were up just 1%. However, General Motors’ SUVs (Tahoe, Suburban, Yukon, and Yukon XL), which together make up more than half of the segment sales, have redesigns on their way in the coming months.

Category: Equipment, Featured, For Sale, General Update, News, Vehicles