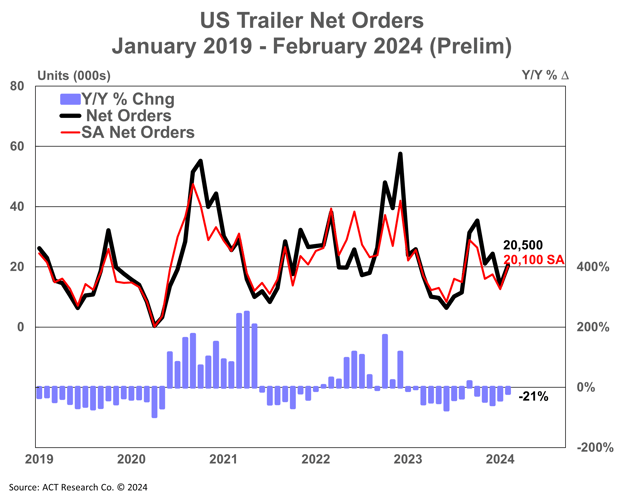

Preliminary Net Trailer Orders in February Higher M/M, But Softer Y/Y

ACT Research report “Net orders remain challenged by a backdrop of weak profitability for for-hire truckers”

February’s preliminary net trailer orders increased nominally from January to February. At 20,500 units, orders were lower compared to last February, down nearly 21% y/y. As we’re at the end of peak order season, seasonal adjustment (SA) lowers February’s tally modestly, to 20,100 units. Final February results will be available later this month. This preliminary market estimate should be within +/-5% of the final order tally.

“Against year-ago data still impacted by pent-up demand that is now gone, softer order intake activity continues to meet expectations,” said Jennifer McNealy, Director CV Market Research & Publications at ACT Research. She added, “Net orders remain challenged by a backdrop of weak profitability for for-hire truckers. Anecdotal commentary from trailer manufacturers and suppliers through the past several months have indicated this slowing, as they have shared that orders are coming, but at a more tepid pace when compared to the last few years.”

She continued, “This month’s results continue to support our thesis that when fleets don’t make money, their ability and/or willingness to purchase equipment is muted. That said, the lower orders now don’t indicate a catastrophic year in the offing, as the economy continues to expand at an above-trend rate in Q1, and goods-producing economic sectors that were out of favor last year are looking healthier in 2024.”

McNealy added, “Another indicator we’re watching closely is cancellations, which remained above comfortable levels for most segments in February. While the industry’s largest segments remain under pressure, some specialty segments have no available build slots until late in 2024 at the earliest and cancellations remain low.”

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Vehicles