Sandhills Global Market Report Shows Used Equipment Values Recovering in Key Truck Markets

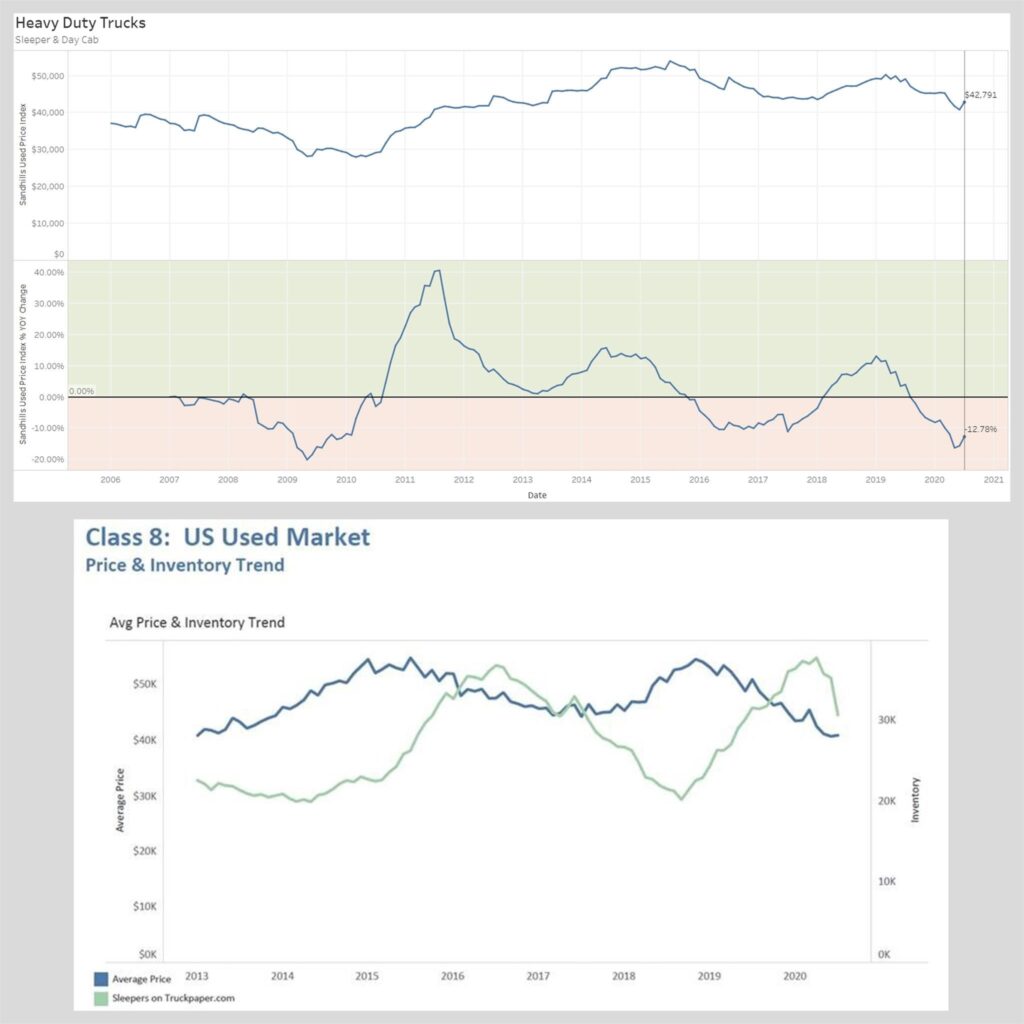

Decreasing inventory in used heavy-duty sleepers and day cabs has helped to increase average used values

As a recent market data report from Sandhills Global illustrates, the fair market value of used equipment can drastically change from month to month. For example, used earth-moving equipment values took a precipitous year-over-year dip from April-June 2019 to April-June 2020, but by July 2020, earth-moving equipment values had returned to nearly what Sandhills observed during July 2019. The heavy-duty truck market (including both sleepers and days cabs) also showed recovery this July, correlating strongly to a large decrease in used inventory.

Used heavy-duty sleeper truck inventory on TruckPaper.com was down 22% in August compared to July. The used inventory numbers, which correlate with changes in key value metrics including asking price per mile and inventory sold, resulted in the largest month-to-month average price increase (up 2%) since the beginning of the COVID-19 pandemic. Used heavy-duty day cab inventory experienced a similar month-to-month inventory drop (down 20%) and average unit price increase (up 3%).

Chart Takeaways

The accompanying truck industry charts illustrate emerging market trends for used heavy-duty sleepers and day cabs. (Note that the “Class 8: US Used Market” chart covers only sleeper trucks on TruckPaper.com, with both inventory levels and used values.) Trends to note include:

- Decreasing inventory in used heavy-duty sleepers and day cabs has helped to increase average used values, highlighted by a recent increase to an average value of $42,791.

- Despite a YOY average value change of -12.78%, July’s YOY percentage change was a marked improvement over the YOY heavy-duty truck marks for June (-15.72%) and May (-16.38%).

The heavy-duty truck market is just one of many industries that Sandhills continuously monitors, and the used inventory on MachineryTrader.com, TruckPaper.com, TractorHouse.com, AuctionTime.com, and Sandhills’ other industry-leading websites and trade publications provide an enormous share of the data that Sandhills tracks for its analysis and reporting. This data is reflected in Sandhills’ Used Price Index—with easy to reference charts like you see here.

Category: Equipment, Featured, General Update, News, Vehicles