Spot Truckload Freight Trends Week Ending Oct 22

DAT: Spot load posts dip 5

Despite higher freight volumes in several key markets, load postings fell 5% nationwide and truck posts dipped 1% during the week ending Oct. 22, said DAT Solutions, which operates the industry’s largest electronic marketplace for spot truckload freight.

National average spot van, refrigerated, and flatbed rates were mostly unchanged compared to the previous week.

National Average Spot Rates for October (through Oct. 22)

– Van: $1.81 per mile, 3 cents lower than the September average

– Flatbed: $2.20 per mile, unchanged compared to September

– Reefer: $2.12 per mile, 4 cents lower than September

Van Trends

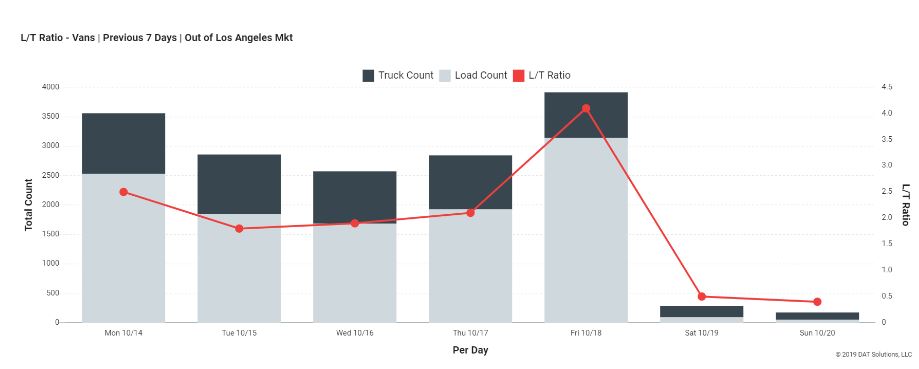

Spot van rates were higher on just 33 of DAT’s Top 100 largest van lanes by volume. Chicago, Dallas, and Los Angeles, three of the most important van markets, all showed higher volumes last week, although average outbound rates declined in each. The Los Angeles load-truck ratio hit 4.1 last Friday after starting the week at 2.5 (neutral) and dipping as low as 1.8 on Tuesday. It’s a sign that import traffic is moving eastbound.

Where rates were up: Volume from Seattle increased slightly and outbound rate gained 5 cents to $1.58 per mile. Key lanes:

– Seattle to Salt Lake City, up 7 cents to $1.94 per mile

– Seattle to Los Angeles, up 6 cents to $1.36 per mile

Seattle is the only major van market where rates are higher over the past four weeks.

Reefer Trends

A combination of produce from Mexico and strong domestic agricultural shipments from California, Florida, Texas, and the Upper Midwest has pushed spot reefer volumes 9% higher over the past four weeks yet the national average rate has declined 3% at the same time.

Where rates were up: Reefer volumes from Nogales, Arizona, increased 68% compared to the previous week and the average outbound rate rose 7 cents to $1.75 per mile. McAllen, Texas, volume jumped 38% although the average outbound rate held at $1.95 per mile. Other high-volume markets last week also had plenty of trucks, which helped tame any changes in rates.

This weekly spot-rate snapshot is derived from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day. dat.com/Trendlines

Category: Featured, General Update, News