Spot Truckload Rates Defy Expectations, Remain Elevated

DAT Spot Truckload Market Summary, Week Ending July 19

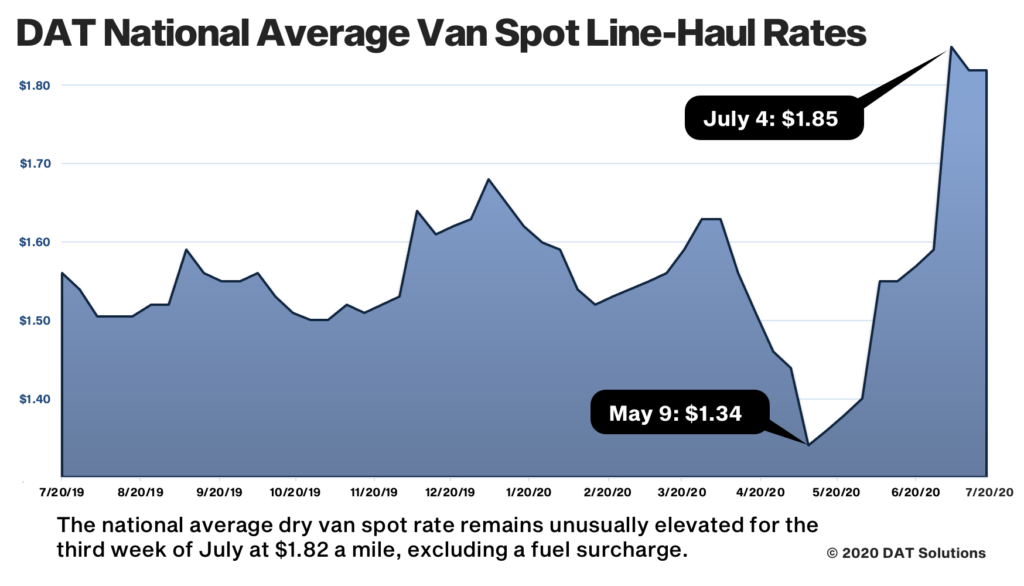

Spot truckload freight rates remained elevated last week despite a slight decline in freight volumes and a modest bump in capacity compared to the previous week, said DAT Solutions, which operates DAT One, the industry’s largest electronic marketplace for truckload freight. Rates have moved higher week over week since the start of July, an unusual pattern as volumes tend to diminish and dry van capacity typically loosens from now through to early October.

Nationally, the number of available loads on DAT One dipped 1.5% while truck posts increased 1.3%.

National Average Spot Rates, July (rolling average including fuel)

– Van: $2.02 per mile, 21 cents compared to June

– Flatbed: $2.18 per mile, up 11 cents

– Reefer: $2.29 per mile, up 14 cents

The line-haul rates (excluding a fuel surcharge) averaged $1.82 for vans, $1.94 for flatbeds, and $2.07 for reefers. These rates are rolling averages through July 19 and include a fuel surcharge.

Trends to Watch

Imbalanced freight networks: Contract and spot prices have not moved in sync as they normally do. Spot rates have risen faster since May and are now close to contract rates for all three major equipment types. This is a direct result of the ongoing COVID-19 pandemic, which points to more inconsistent freight volumes and unbalanced carrier networks in the short-term as shippers send more loads to the spot market to meet erratic demand and carriers increasingly become more selective about the contract loads they haul.

Retail van freight volumes: Average spot van rates were higher on 65 of DAT’s top 100 lanes by volume compared to the previous week while the volume of loads increased on 90 lanes. Pricing edged higher in several key retail freight hubs compared to the previous week:

– Allentown, Pa.: $2.36 per mile, up 16 cents

– Los Angeles: $2.84, up 8 cents

– Memphis: $2.48, up 8 cents on a 35% increase in load volumes

– Houston: $1.94, up 3 cents

Southern California vans: Los Angeles and Ontario, Calif.—key hubs for import traffic—recorded a 19% drop in load posts from the peak on June 27 and are now back to seasonal levels. Just over 15% of Los Angeles and Ontario-outbound loads last week were destined for the major warehouse markets of Stockton and Phoenix, which is consistent with the staging of imports for back-to-school retail season.

Seasonal reefer rates: Average rates were higher on 33 of DAT’s top 72 reefer lanes by volume compared to the previous week. Nineteen lanes were neutral.

Produce shipments: Reefer volumes on DAT One’s top 72 lanes declined for the fourth consecutive week. The U.S. Dept. of Agriculture reported that seasonal truckloads of domestic produce fell 8% and imported produce fell 3%. That’s the equivalent of 4,868 fewer loads than the prior week. Produce volumes from Mexico continue to fall from their mid-June high, but are down 6% year over year due to decreased demand in the U.S. foodservice sector. Load volumes from the California produce markets of Fresno, Ontario, Stockton, and San Francisco increased 9% week over week and are now up 28% over the last three weeks.

Flatbed volumes mixed: Flatbed load volumes were mixed last week, with 37 of the top 78 flatbed lanes trending higher compared to the previous week.

Volumes in the Southeast remain strong, however, especially from Alabama, Texas, Arkansas, Georgia, and Mississippi. Load posts out of the region topped 211,000, which represents a 17% week over week and 31% month over month increase. Spot rates are also up 15% over the last three weeks. In Texas, the Fort Worth and Lubbock were hot markets for available trucks. The average rate on 58 origin-destination pairings increased from $1.90 to $2.09 per mile, with shorter, regional moves to Shreveport, La., and Little Rock, Ark., paying $3.23 and $2.94 respectively.

Category: Driver Stuff, Featured, General Update, Management, News