Truckers Shift Capacity To The Spot Market

DAT Trendlines summary, week ending April 11, 2021

Truckload rates bring more capacity to the spot market

With truckload rates at historic highs, an increasing number of carriers made their equipment available on the spot market last week, said DAT Freight & Analytics, which operates the industry’s largest load board network.

The total number of loads posted to the DAT marketplace jumped 4.7% during the week ending April 11 but the number of available trucks was up 5.3%. Spot prices for van and refrigerated truckload services on many of the country’s busiest lanes leveled off despite more available freight compared to the previous week.

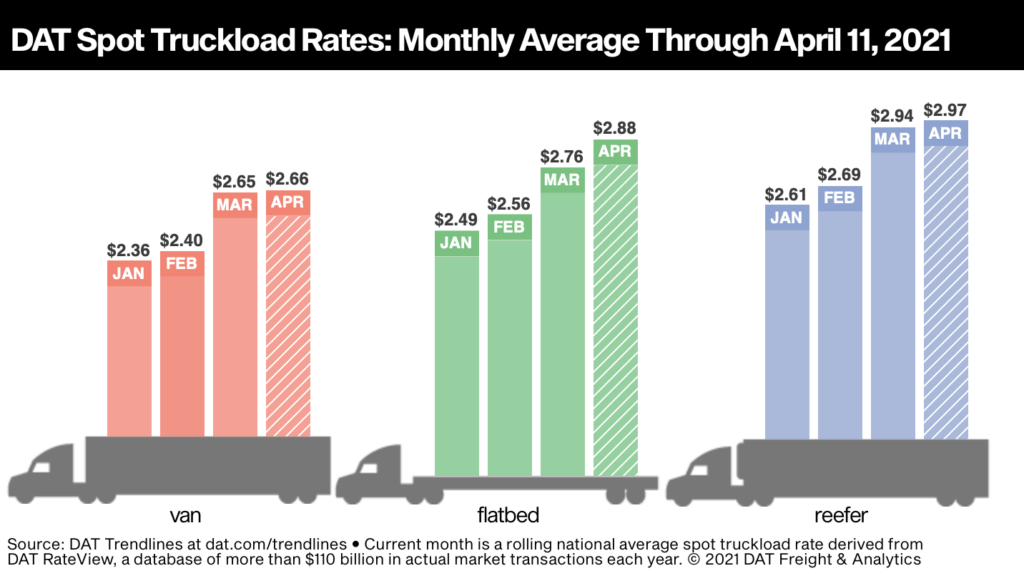

National Average Spot Rates, April

– Van: $2.66 per mile, 1 cent higher than the March average

– Flatbed: $2.88 per mile, 12 cents higher than March

– Refrigerated: $2.97 per mile, 3 cents higher than March

These are national average spot truckload rates for the month through April 11 and include a calculated fuel surcharge. The national average price of diesel was unchanged at $3.14 a gallon compared to the previous week.

Van volumes dip on top lanes: The average rate increased on 50 of DAT’s top 100 lanes and was neutral on 19, although overall volume on those 100 lanes was down 4.6% week over week. The national average van load-to-truck ratio was unchanged from the previous week at 5.3, nearly 0.5 lower than the March average.

Van lanes to watch: Los Angeles to Stockton averaged $3.79 a mile, up 11 cents over the previous week. In Los Angeles, capacity remains tight due in part to high import volumes at the ports of Los Angeles and Long Beach. For all outbound loads, Los Angeles was up 6 cents to an average of $3.38 a mile.

Reefer load-to-truck ratio tumbles: While the number of loads moved on DAT’s top 72 reefer lanes by volume declined 2.5% compared to the previous week, the average rate edged higher on 38 of those lanes, neutral on 13, and lower on 21 lanes. The reefer load-to-truck ratio slipped from 11.5 to 10.6 as a national average.

Florida reefer markets on the rise: Florida markets were on the upswing as produce volumes rise. Miami outbound averaged $2.86 a mile, up 15 cents compared to the previous week, while Lakeland averaged $2.59 a mile, a 16-cent increase week over week. Ontario, California, remained a hotbed for spot reefer freight. Two lanes to note: Ontario to Phoenix increased 20 cents to an average of $4.49 a mile; Ontario-Stockton was up 14 cents to $3.88 a mile.

Flatbed volumes level off in major markets, but trucks are hard to find: The average spot rate increased on 48 of DAT’s top 78 flatbed lanes by volume. Twenty lanes were neutral and 10 lanes declined compared to the previous week. The national average flatbed load-to-truck ratio slipped from 96.2 to 94.7 last week.

Flatbed lanes to watch: Capacity is extremely tight across most of the country and especially the U.S. southeast on the strength of construction, manufacturing and agriculture. Four of the top five flatbed lanes by volume originated in Texas last week. The country’s high-volume lane last week was Houston to Fort Worth, averaging $2.87 a mile, up 4 cents week over week. The return leg averaged $2.56 a mile.

Category: Driver Stuff, Featured, Fleet Tracking, General Update, News